Godrej gears up for rising demand in large-tonnage dies, cutting import reliance

By Staff Report October 1, 2025 7:37 pm IST

India’s tooling sector is steadily building competitiveness against established hubs like China, Taiwan, and Germany by combining cost advantages with rising technological depth. India offers a unique edge through cost competitiveness, reliability, and a fast-growing ecosystem of advanced technologies. Pankaj Abhyankar from Godrej Enterprises Group shares the larger plan of Godrej Tooling and how the government’s thrust on Make in India and the localisation programmes of global OEMs are further accelerating their shift.

How has the tooling business within Godrej Enterprises evolved in recent years, and what was the major force behind this growth?

The tooling business of Godrej Enterprises Group has evolved into a technology-driven and customer-centric solutions provider, recording 40% growth last year. This progress has been largely fueled by the automotive sector’s transition towards electric vehicles and the growing need for lightweight aluminium components, which require high precision, porosity control, and complex geometries.

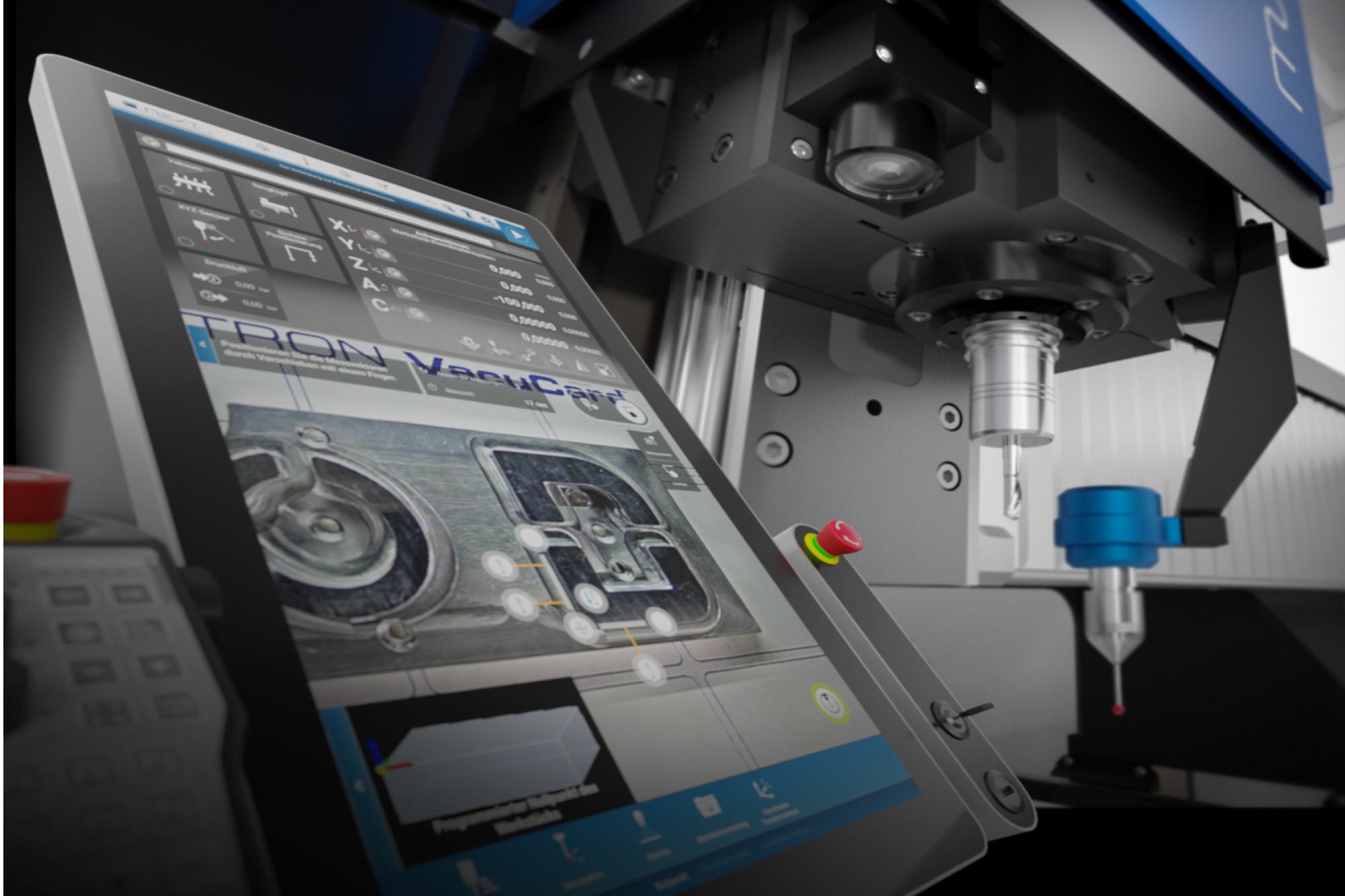

To address these shifts, we invested in advanced technologies such as AI-enabled smart dies, IoT-based real-time monitoring, and Industry 4.0 practices. We have also collaborated with global leaders to strengthen our capabilities in giga-casting and structural parts. By positioning ourselves as a total solutions provider with end-to-end services, from early product design consultation to in-house prototyping and small-batch production, we have been able to deliver higher value to OEMs, particularly in the EV space.

What challenges do you see in the Indian tooling sector, and how can companies overcome them to remain competitive globally?

One of the key challenges in the Indian tooling sector is the need to shorten tool development lead times and achieve “first-time-right” outcomes, as global customers increasingly demand precision, speed, and reliability. Indian toolmakers also face the task of scaling up to produce dies for large castings on machines with a capacity of 3000–4000 tonnes, which are often imported, thereby limiting their cost competitiveness. Another challenge lies in building comprehensive, end-to-end solutions that go beyond tool supply to include design collaboration, prototyping, and process validation. Indian companies must invest in advanced technologies such as simulation, digital twins, and Industry 4.0 practices to reduce errors and scrap, while enhancing productivity and tool life to remain competitive globally. Indian tooling companies can move up the value chain and establish themselves as strong contenders in the global market by focusing on precision, scale, innovation, and sustainable practices.

The tooling industry faces high duties on tool steel and high-end machines. How are you addressing them?

At the Tooling business of the Godrej Enterprises Group, we employ a combination of strategies to remain competitive. Our focus is on capacity optimisation and low-cost automation to improve efficiencies and offset input cost pressures. By engaging with global consultants and implementing advanced machining and cutting tool technologies, we are reducing dependence on expensive imports while improving productivity. The tool steel is yet to be imported because the locally made options are not yet available. However, we are driving our customers to localise peripherals by handholding and developing domestic alternatives by demonstrating and proving them at our end.

What is the current market share of Godrej in the Indian tooling sector, and which industries contribute the most to your business?

The current market share of our tooling business in die-casting dies is 11% in the chosen categories , which include more than 660 T dies. We have aligned our business with the stable and growing auto industry. More than 85% of our business is generated from automobile powertrain, engine and EV parts.

The automotive sector, particularly passenger vehicles and the fast-growing electric vehicle (EV) segment, contributes the most. We are also increasingly involved in railways, with the advent of high-speed rail and modern rolling stock creating opportunities, as well as in aerospace, where precision and reliability are critical.

Approximately 34% of India’s tooling demand is met through imports, with a significant share coming from select countries. How is Godrej addressing this?

We are addressing this by focusing on localisation and technology partnerships to reduce dependence on imports. For instance, we are already developing capabilities to manufacture dies for large castings on 3000–4000 tonne machines, which are typically imported, providing customers with a cost advantage. Furthermore, through collaboration with Krämer & Grebe, a leading German toolmaker, we are bringing advanced know-how in structural parts and gigacasting technologies to India, aligning with the localisation programs of global OEMs. Additionally, investments in advanced simulation, in-house vacuum-equipped foundries, and Industry 4.0 practices enable us to deliver world-class quality and “first-time-right” solutions, thereby reducing our reliance on overseas suppliers.

What strategies should Indian toolmakers adopt to strengthen their global position?

Indian toolmakers need to focus on precision, scale, innovation, and sustainability. First, investing in advanced technologies such as digital twins, AI-driven simulations, and Industry 4.0 practices will help shorten lead times, improve first-time-right outcomes, and reduce rejections, a key factor for competing globally. Second, building capabilities in large and complex castings (such as 3000–4000 tonne dies used in giga-casting) will reduce dependence on imports and allow Indian companies to service global OEMs cost-effectively. Third, toolmakers should develop end-to-end solution offerings—from early design collaboration to prototyping and small-batch production so that they can support customers through the entire product development cycle. Sustainability practices such as die refurbishing, energy-efficient processes, and the use of recyclable materials are becoming key differentiators, as global customers increasingly assess suppliers on their green credentials.

What percentage of your tooling business is export-oriented, and which international markets are you focusing on?

For the Die-casting business, we are targeting 5-7% of NBV from exports. We are pitching in the EU & UK markets through our MOU partner M/s. Kramer & Grebe. With the current FTA between the UK & India, we are looking forward to enhancing our share with our existing customers.

What investments are being made in advanced manufacturing technologies like additive manufacturing, high-speed machining, or automation within your tooling business?

We are actively investing in advanced manufacturing technologies to strengthen our capabilities and support next-generation applications. The business has successfully deployed additive manufacturing (3D printing) in die-casting dies to manage complex geometries required for EVs and aerospace.

On the automation front, we are introducing low-cost automation solutions, along with IoT-enabled smart dies that monitor up to 25 parameters in real-time, improving traceability, reducing rejections, and extending tool life. Additionally, simulation platforms like Magma, which act as digital twins, are being used to optimise designs and achieve first-time-right outcomes.

What is your annual tool production, and do you have expansion plans to scale this further?

We define our die-making capacity in terms of unit dies. One unit die is equivalent to 800 T, a 2 Wheeler Transmission die. The annual capacity is 240 Dies.

We are targeting a 20%+ capacity enhancement, focusing on de-bottlenecking operations, adding infrastructure, and leveraging low-cost automation and advanced machining technologies to release additional capacity.

We are also preparing for the growing demand in large-tonnage dies, moving beyond 2500–3000 tonne tools to address the upcoming need for 4000 tonne and higher machines as giga-casting gains traction in India.

What key trends will shape the Indian tooling industry in the next decade?

Over the next decade, the Indian tooling industry will be driven by the shift towards electric vehicles, which demand lightweight aluminium structural parts and complex geometries, creating opportunities for advanced die-casting solutions. Giga-casting and large structural castings will gain prominence as foundries in India invest in higher-tonnage machines, reducing their dependence on imports. Magnesium Die-casting has significant potential to grow once an ecosystem for its recycling is established in the country. The newer processes of Die-cast part production, such as rheocasting, Thixo-Moulding, and counter-pressure casting (CPC), have been developed to meet the specific requirements of product designs. These are currently at a very nascent stage in India. At the same time, digitalisation through AI, IoT, and digital twins will become mainstream, enabling predictive maintenance, improved traceability, and first-time-right production. Another defining trend will be sustainability, with practices such as die refurbishing, energy-efficient operations, and the use of recyclable materials becoming critical to customer decisions.

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.