IACE spearheads skill development and sustainability with EV boom

By OEM Update Editorial February 28, 2024 3:09 pm IST

The International Automobile Center of Excellence is a joint venture between the Gujarat government and Maruti Suzuki. It is an apex ecosystem for various skill development, training, and education forms. E Rajiv, Executive Director of the International Automobile Centre of Excellence, shares how the centre offers educational programs for newcomers and professionals and extensive training initiatives for current faculty and senior management.

Can you elaborate on the organisation’s role and affiliations in the education sector?

We operate as a dual body approved by NCVET, responsible for assessment and awarding functions. As affiliate partners with Kaushalya Skill University of Gujarat and MOU partner the Central Technological University of Gujarat (Gujarat Technological University), we offer a variety of courses for 10+,12th ,ITI,diplomas, and engineering students. Our collaboration with Kaushalya Skill University extends to skilling courses and a BSc program in transportation and mobility. In addition, our recent association with NCVET has led to the initiation of job-focused micro-credits and course on vehicle end-of-life. We anticipate expanding these offerings in the upcoming financial year.

What are your current projects and focus areas in the automotive industry?

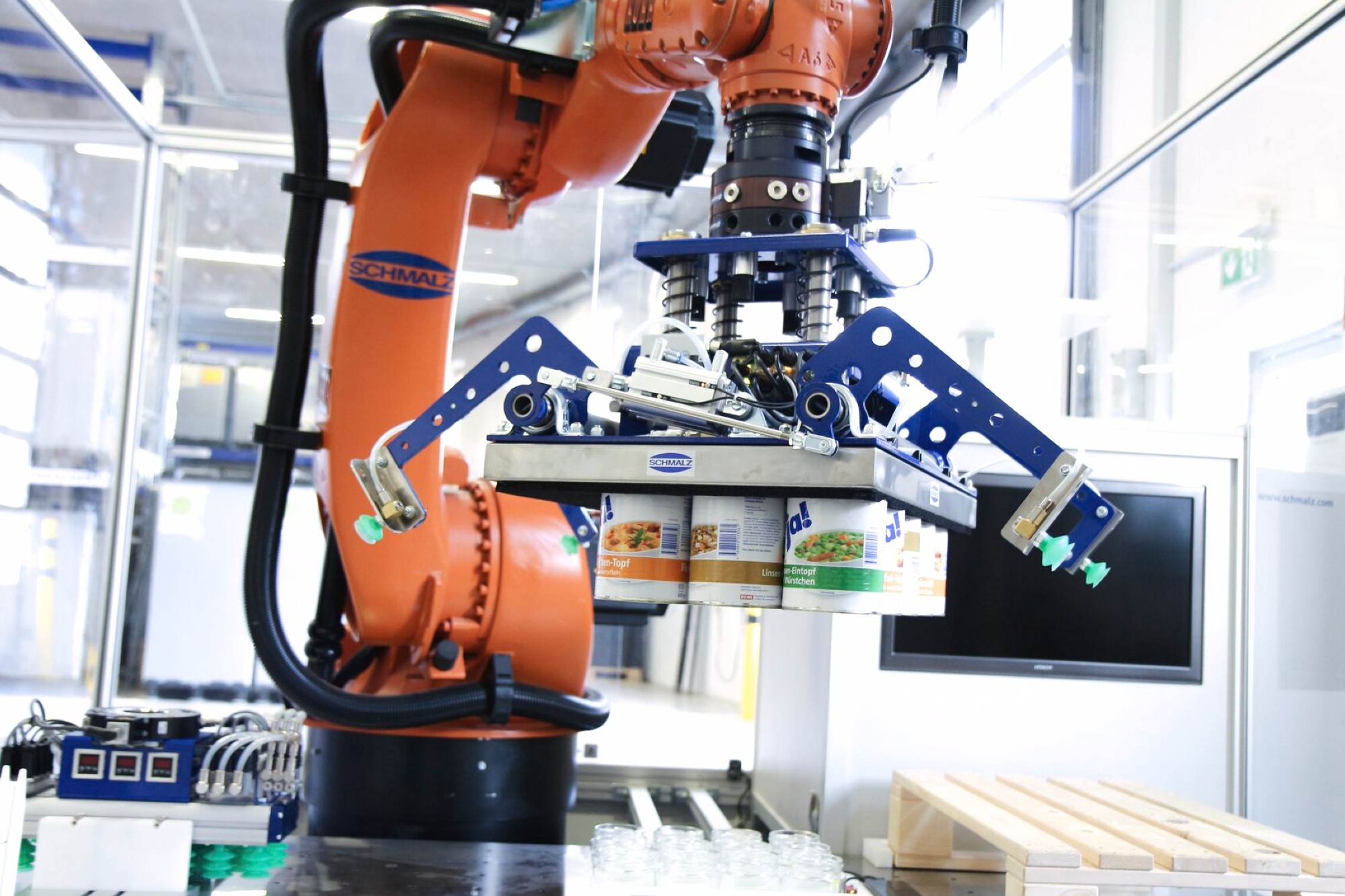

Our primary focus lies in skill development within the automotive system, manufacturing, and Channel Management domains. Our ongoing projects include apart from advance centred around assessing the recyclability of vehicles, addressing a significant challenge in states with high pollution levels and a desire to phase out older vehicles. This initiative aligns with promoting sustainability, especially in the case of steel, a crucial component in vehicle manufacturing. By leveraging nearly 99% pure steel from end-of-life vehicles, we aim to contribute to substantial carbon credit savings for end-users.

Global economies are increasingly adopting circularity practices, and we have initiated efforts in this direction. Plastic, a major component in the automotive industry, poses challenges due to its limited biodegradability. Our focus is on repurposing, remodelling, and reusing automotive-grade plastic. As we venture into electrification, the emergence of EVs brings unique challenges in battery disposal and managing additional e-waste. This early-stage exploration is crucial, considering the impending complexities associated with EVs.

What are the major challenges faced by automotive and manufacturing companies?

The automotive sector contributes 7.5% to the Indian GDP. But when we shift our focus to the education sector, its share is disproportionately minuscule, even less than 1%, and falls into finer decimal fractions of that percentage. This disparity indicates a substantial scale deficit, where the workforce is not aligned with the demands at various levels, leading to inefficiencies and varying productivity levels across domains. The presence of numerous individuals without the right skills creates a challenge, resulting in increased expenses.

The lower productivity levels and the multitude of individuals contribute to reduced salaries for individuals, as organisers need more efficiency to meet payroll. Addressing these challenges is a priority, and the IACE approach involves initiating entry-level programs to ensure that the workforce is prepared right from day zero. Subsequent phases include retraining, re-packaging, and providing professional guidance and training to enhance the skills of the existing ecosystem. We collaborate with industries and university partners to offer comprehensive support for hiring and mobilisation.

Please share a brief about the collaborative efforts and partnerships with industry players, academic institutions, and government bodies to drive innovation in the automotive sector.

IACE has established collaborations with various state governments and their departments, such as the Department of Employment and Training and the Department of Technical Education. We also serve as a facility partner with TDU, and our network extends to about 15-20 associations, encompassing core universities and over 200 colleges.

Contributing towards industry, we are actively engaged with forums, providing us access to domains with a demand for skilled workforce. We want to expand into areas where businesses face challenges acquiring the right talent and aim to supply them with skilled individuals.

Our initial focus was on Gujarat due to the government’s backing, but we are open to expanding to other states based on their specific needs. Education falls under the concurrent list, and each state has priorities, whether in retail, manufacturing, or other industries. Therefore, we recognise the importance of prioritising states based on their specific industry focus, such as automotive.

What are the key domains for the automotive industry in your training programs?

Our course offerings span four domains, covering essential manufacturing processes such as injection moulding, welding, painting, and machining. Press operations are also in the plans, likely facilitated through external arrangements due to space constraints. Additionally, we provide a variety of short-term customised programs tailored for industry professionals. We have established partnerships with several aftermarket players to support the training environment for handling vehicles in that ecosystem.How does the current state of the auto component industry correlate with the national economic goals?

The auto component industry is tied to vehicle sales, and India currently represents one of the most promising global markets. With India aspiring to become a $5 trillion economy and favourable conditions in capital markets, there is an anticipated surge in personal mobility. This is further fueled by a trend towards premiumisation of cars, increasing the demand for various components.

The longer life cycle of cars in India and the pending enforcement of end-of-life regulations present a significant volume for component manufacturers in the aftermarket. In an attempt, the component manufacturing space is becoming increasingly lucrative each year, with the aftermarket playing a substantial role in this upward trajectory.

How will the EV boom affect the auto component industry?

The penetration of EVs varies across different types of logistics in India. While there is higher adoption of EVs in two-wheelers for city commuting, the personal space EV penetration is relatively low, currently at around 2-3%. Price points play a significant role in this, influenced by policies like FAME that impact customer affordability. Discussions also revolve around the EV cycle’s resale value, a more straightforward consideration in traditional ICE models.

Expectations suggest that the automotive ecosystem will continue to include petrol, diesel, CNG, LPG, hybrid, mild hybrid, plug-in hybrids, and pure EVs for an extended period. With an influx of players entering the EV market, new and existing component manufacturers contribute to the growing ecosystem driven by economic factors.

Despite the fewer components in EVs compared to ICE engines, the nature of these components, the ecosystem requirements, and after-sales needs differ significantly. Diagnosis becomes crucial, and possibilities for prognosis emerge. The evolving landscape presents opportunities globally, with major players like Tesla yet to make a significant entry into the Indian market. The existing ecosystem is expected to remain, with new additions in the EV sector contributing to the volumes in component manufacturing. As time progresses, the component manufacturing phase is foreseen to become even more lucrative.

Can you share the outlook for the mid-term future in the auto components sector, with increasing growth in consumption of EVs?

Significant growth is anticipated in the automotive industry, driven by a few compounding factors. First would be the inherent growth of industry fueled by an increase in the number of cars and improved road infrastructure in India. This leads to higher wear and tear, necessitating more replacements and increasing demand for components. Secondly, EVs, advanced technologies, and electronics will add another layer to the existing ecosystem, requiring additional components such as sensors for enhanced functionalities.

The premiumisation trend is prevalent across all sectors, including the automotive industry in India. However, the country’s price-sensitive and reasonably taxed ecosystem influences the pace of adoption. High-end cars are experiencing substantial growth due to the higher disposable income of individuals in that segment.

How is the auto component sector influencing growth in both domestic and international markets?

Globalisation significantly impacts the auto component space, with numerous joint ventures formed to align companies and make technology accessible globally. This collaboration benefits both Indian and international companies by leveraging the skills contributed by each side. India’s reputation for a cost-effective workforce makes production costs more competitive, enhancing our position for global launches and increasing export potential.

While initially, there were fewer global launches in India, the current scenario sees all vehicle launches in the country being global. This establishes the status of India on a level playing field globally, supporting the international adoption of Indian goods. Collaborations also contribute to maintaining a quality standard, combining the known brand of the international partner with the quality products produced in India.

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.