Achieving economies of scale is critical to drive EV sector

By OEM Update Editorial June 9, 2021 2:10 pm IST

Reinventing EV and EV charging for India is the way forward and many like-minded companies are working on this line.

Discussing the encumbrance of EV in Indian automotive market, Maxon Lewis, Managing Director, Magenta Power, highlight the opportunities and challenges and the required financial assistance to push the idea of EV in India.

Infrastructural development to set up EV charging stations in India is said to be a challenge. How is the industry reinventing the thought?

The development of EV charging infrastructure in India faces numerous and distinct challenges. The 4 keys amongst them are Heat, Humidity, Harmonics and Humans. As a result, India’s EV charging infrastructure cannot be a cut-and-paste solution from European or American countries. Having said that, these challenges provide an opportunity to solve problems which, in effect, can then become the benchmark for other South East Asian countries. And Magenta has been the front runner in making EV charging solutions in India, for India.

Let us take two cases in points –

- Extending the usage of Streetlamps for EV charging. The ChargeGrid Flare is one such product.

- Residential charging where dedicated parking is not available. Magenta has deployed a shared charging solution (hardware, software and deployment model) at a few high rises.

We are working closely with several Residential Federation Associations (RWA) and housing societies to take this solution from pilot to scale.

Under the PLI scheme, what kind of opportunities do you expect for the local battery makers and solution providers?

The Production Linked Incentive (PLI) scheme, which is aimed at boosting domestic manufacturing and export, can push the use of electric vehicles (EV), which have faced headwinds in India given the high battery costs. Indian companies generally import batteries, which account for more than half the cost of an EV. The government has proposed building local manufacturing facilities. One of the key aspects of the scheme is that the proposed battery policy is output-based rather than input-based. The subsidy is linked to the output manufactured and the value addition achieved by private entities. Private entities will be eligible for a government subsidy only if they achieve a 60 percent value addition within five years of the date of commencement of the project that is when they are expected to reach full-scale production. This is actually a very smart way of encouraging battery manufacturing in India.

But like with all well intended schemes, a few things will be key to ensure proper implementation – 1. Ensuring the benefits of the scheme is indeed passed on to entities which make investments on this account and now to change the goal post midway. Second is to be discreet to offer the benefits of the scheme to companies who are investing in cell manufacturing capabilities and not battery pack assembly lines. Otherwise, the entire intent will be lost in the creation of an unfair and unfavorable system.

India is aiming to have 30 percent of EV in India, but the adoption of EV is yet to pick up. What measures are being taken by the industry and the government to make it a reality?

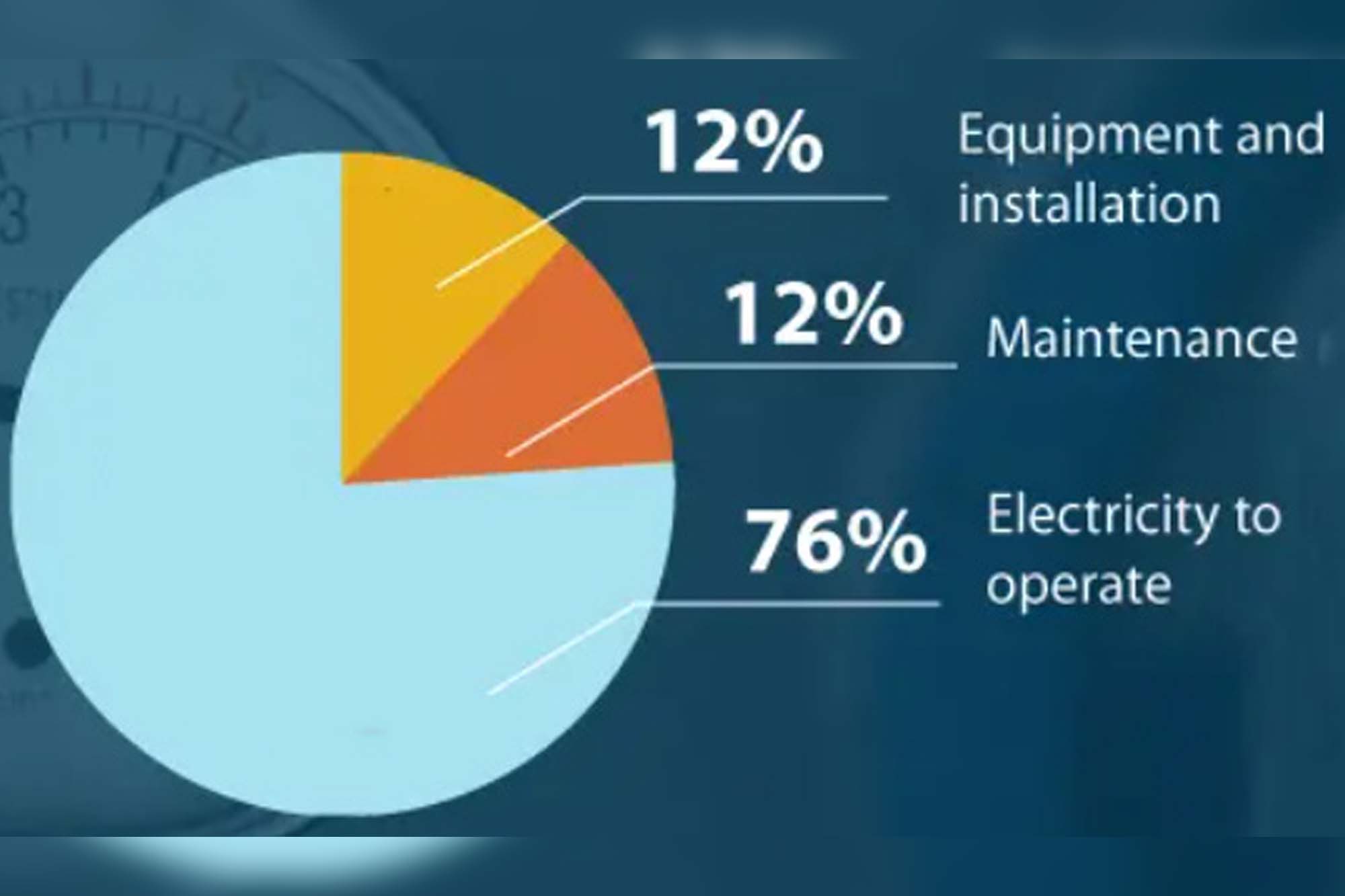

What are the existing challenges towards energy storage and power solutions for EV charging stations?The EV charging station is primarily powered by the grid, which can be replaced by a solar photovoltaic system. However, there are some inherent technical challenges to Solar PV, like – Variability of PV power generation, Diurnal nature of PV power generation and nocturnal consumption load for charging. Both these challenges can be solved by intermediate storage (local battery storage). The additional cost of solar and battery is what makes the business case prohibitive as of now. But having set up India’s first solar based EV charging station in 2018 and learning from that pilot and many others, we are working on reducing the cost of this setup by leveraging some components already existing in the ecosystem. We believe the business case for this additional capex even after optimisation will be driven by utilisation of the chargers.

What is the required legislative support for EV transition and reducing carbon emissions?

I will limit the response to this question to purely EV adoption. One of the policies in waiting is the one to mandate EV charging in new apartments. This will drive confidence and adoption. This coupled with the scrappage policy and the technical solutions falling in place will drive the adoption on a mass scale.

How do you correlate the current fuel price rise and the relevance of EVs in this scenario?

Of late, petrol and diesel prices in India are on a vertical trajectory upwards. The increasing prices are indeed pushing the business case in favour of EV. The math is quite simple and if we use the example of an EV in New Delhi. Here, charging the vehicle at home will cost around ₹6.25 per unit. At this range, the full charge for 40 KwH will cost ₹250 in 6-8 hours. A 40 KwH battery, found in the new EVs being offered and which is bound to become the choice, offers a range of about 300-350 km on a single charge. This brings us to a running cost of ₹1 per km for an electric vehicle with a 40 KwH battery being charged at home as compared to ₹6 per km for an average ICE vehicle.

EV is no longer the future; it is the here and now.

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.