Growing awareness of climate change is driving demand for EVs

By OEM Update Editorial September 11, 2023 4:39 pm IST

Rohit Saboo, President & CEO of National Engineering Industries, deliberating sustainability, states that businesses and governments increasingly show interest in EVs, with e-commerce companies adopting e-Mobility for eco-friendly last-mile deliveries to reduce carbon emissions.

What latest advancements will make India the third-largest automotive industry globally by 2030?

By 2030, India aims to become the world’s third-largest player in the automobile industry. It is currently the fifth-largest market, and by 2030, it wants to be all-electric. The nation’s ambitious plan involves transitioning entirely to electric vehicles (EVs) by that year. This shift is driven by several key factors: reducing reliance on foreign oil imports, curbing pollution, and fulfilling international commitments related to climate change.

To facilitate the growth of the Indian EV industry, the country is making substantial investments. These investments include establishing a new production centre and developing an enhanced charging infrastructure. The government has introduced the Production Linked Incentive (PLI) scheme to promote domestic production of EVs, hydrogen fuel vehicles, and local ACC battery storage products. In 2021, India saw the sale of more than 300,000 EVs nationwide.

In the fiscal year 2023, the automotive sector’s capital expenditure (capex) is expected to exceed $3 billion, equivalent to Rs 27,000 crore, showing an impressive year-over-year growth rate of 24 percent. Key drivers of this expansion include accessible auto financing, transparent financing options, and the increasing popularity of electric vehicles.

In addition to these factors, here are some burgeoning trends expected to shape the Indian automotive sector in 2023:

Rapid Growth in Autonomous Vehicle R&D: Investments in research and development for autonomous vehicles have significantly increased. Recent technological advancements have opened up new opportunities for automakers to explore autonomous vehicles to enhance the commuting experience, and this trend is expected to gain traction in 2023.

Leveraging 5G Technology: Cars typically have around 100 million codes and 30,000 parts, and recent technological advances have expanded those numbers even more to aid drivers in navigation. The introduction of 5G technology is poised to be a game-changer, allowing wireless communication of crucial information such as traffic updates, weather conditions, and road conditions while on the road.

The Internet of Things (IoT) in Connected Cars: IoT forms the foundation for connected cars, which offer enhanced safety, comfort, and on-demand services. These advanced modes of transportation can collect and share data, enabling services like digital data sharing, remote diagnostics, vehicle health reports, data-only telematics, 4G LTE Wi-Fi hotspots, turn-by-turn directions, and proactive measures to prevent breakdowns.

Increasing Emphasis on Electric Vehicles: Growing awareness of climate change issues drives interest in electric vehicles. In 2023, the sale of EVs is expected to surge, with the highest selling year in 2022 reaching 429,217 units, marking a remarkable 218 percent increase from the 134,821 units sold in 2021. This reflects a broader national commitment to reducing carbon footprint and achieving sustainable development goals.

How are I 4.0 technologies practised for sustainability in the automobile industry?

During the recently concluded COP27 summit, global leaders unveiled an ambitious objective for our planet: to attain net-zero emissions by 2070. The automotive sector plays a crucial role in helping achieve this goal.

Industries are adopting sustainable practices and integrating innovative technologies within their supply chains to work towards zero emissions. Central to enhancing these supply chains’ sustainability are the principles of a circular economy and end-to-end visibility from start to finish.

Following are the trends that can be witnessed:

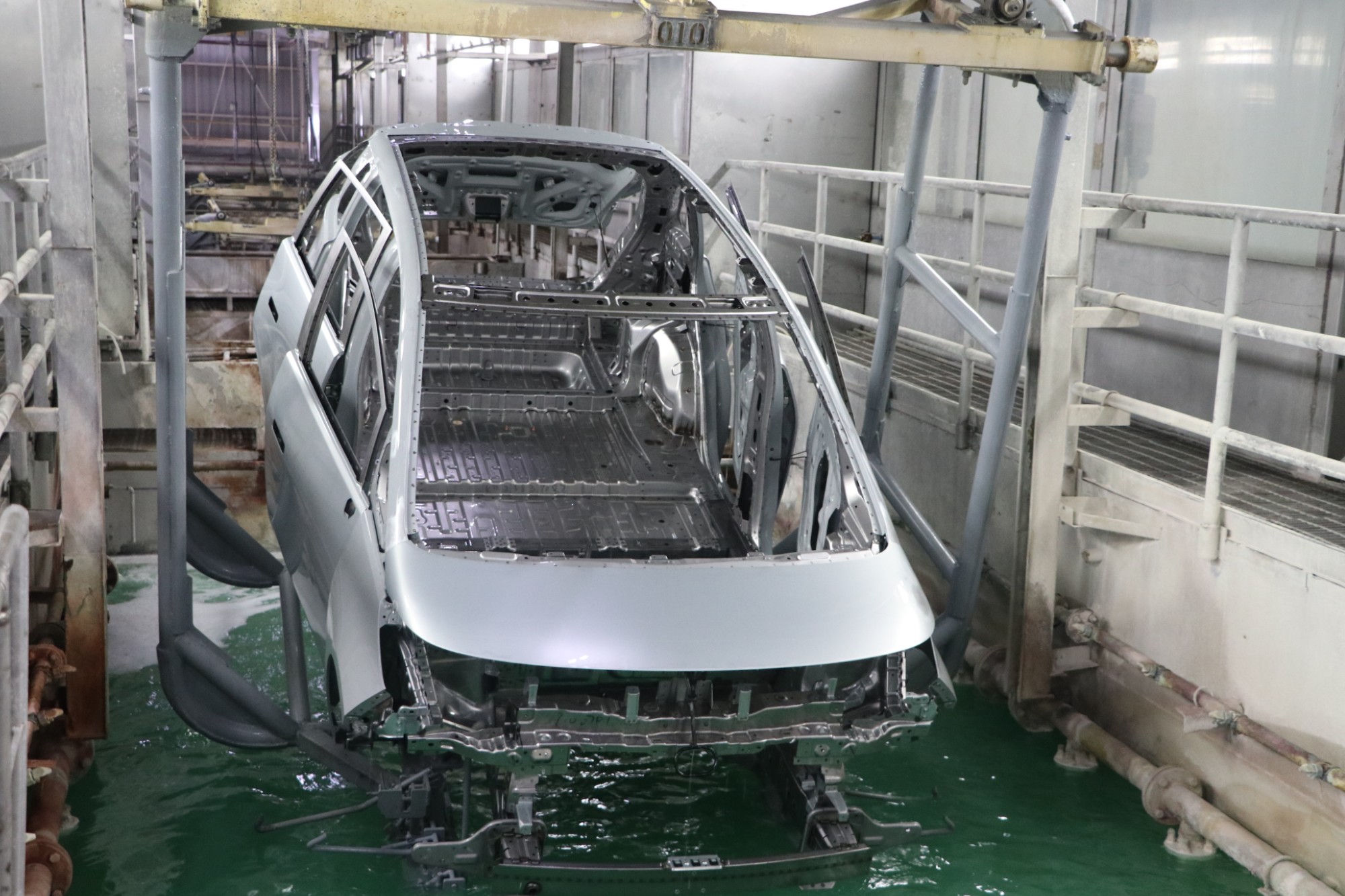

Original equipment manufacturers (OEMs) increasingly seek greater transparency across their supply chain to monitor and improve sustainability. This transparency is essential to ensure every component is produced with the utmost sustainability. Through comprehensive traceability and visibility of components, the carbon footprint of each part can be accurately determined. This allows OEMs to prioritise purchasing components from vendors with the lowest carbon footprints whenever possible.Another approach OEMs adopt to enhance sustainability involves reimagining the assembly line, a longstanding cornerstone of the automotive industry. For many decades, cars have been predominantly manufactured on assembly lines, boosting production efficiency and generating significant waste and energy consumption. As a response, several OEMs are revisiting manufacturing methods used before the invention of assembly lines. Modular manufacturing represents the opposite of an assembly line and is being utilised as a more sustainable alternative.

A growing number of executives joining automotive companies are enthusiastic about integrating sustainability into various aspects of their business operations. Consequently, internal organisational dynamics serve as a driving force behind sustainability efforts.

The automotive sector has compelling reasons to believe it can achieve its goal of becoming a net-zero emitter. Over the past 15 years alone, the industry has undergone remarkable advancements. Electric cars (EVs) have transformed in this comparatively short time from being on the fringe to becoming mainstream, highly desired automobiles used daily by millions of homes.

What macro factors and trends influence transitioning towards EV manufacturing and charging infrastructure?

India intends to become the global leader in the sale of electric vehicles. As a result, multiple big manufacturers and EV start-ups have invested much time and money into creating electric vehicles over the past five years. This surge in investment has resulted in a notable increase in adopting Battery Electric Vehicles (BEVs).

The Indian Electric Vehicle Market is poised for remarkable growth, with a projected Compound Annual Growth Rate (CAGR) of over 44%. It is expected to reach a market size of USD 47 billion by 2026, a substantial leap from its 2021 size of USD 5 billion.

The government has implemented various programs and regulations to promote the expansion of the EV industry. Incentives have been offered to consumers and manufacturers to stimulate the EV sector. Notably, businesses and governments are increasingly interested in EVs, with e-commerce companies adopting e-mobility for eco-friendly last-mile deliveries to reduce carbon emissions.

At NBC, we have already initiated developing and validating our bearings for electric vehicles (EVs), featuring sensor-integrated bearings (SIB) designed in-house. These bearings offer superior attributes to standard ones, including higher rpm capability, reduced noise and friction, increased power density, and extended lifespan. We have already supplied these bearings to some EV Original Equipment Manufacturers (OEMs) in the 2W, 3W, and passenger car segments, and we are collaborating with major OEMs in the commercial vehicle sector. Our research and development team also works closely with OEMs to create custom-bearing solutions to meet their specific requirements. We are working closely with domestic and international OEMs to provide them with optimised bearing solutions for their upcoming vehicles, ensuring they are well-prepared for the future.

What role does FAME II play in promoting production capacity and electric vehicle manufacture?

The Faster Adoption and Manufacturing of Electric Vehicles in India (FAME II) scheme is vital in promoting the production capacity and manufacture of electric vehicles (EVs) in India. Launched by the Indian government in 2019, FAME II aims to accelerate the adoption of EVs and create a robust manufacturing ecosystem for electric mobility in the country. Out of total monetary support, about 86 percent of the fund has been allocated to create demand for EVs in the country.

FAME II is an effort towards boosting domestic production capacity for electric vehicles and components. The scheme encourages domestic manufacturers to invest in EV production facilities and develop advanced technologies, thereby creating job opportunities and promoting the growth of the EV industry in India. The scheme also promotes local manufacturing of EV components, including batteries, motors, and power electronics, to reduce import dependency and strengthen the domestic supply chain.

What opportunities do you see for software and technology providers for the electrical mobility automobile sector?

These are fascinating times for software and technology providers, with the electrical mobility sector seeing a boom. With the rising adoption of electric vehicles (EVs), there is a corresponding increase in the demand for charging infrastructure solutions. Software providers can work towards developing smart charging solutions, mobile applications for charging station locating and monitoring, etc.

What latest innovations are happening in the automobile industry with robotics and 3D printing implementation?

Modern technologies like artificial intelligence (AI) and robotic automation are viewed as a significant advantage for the automotive sector. These innovations are crucial in fleet management, enhancing driver safety, and optimising vehicle inspection and insurance services. Additionally, 3D printing offers multiple benefits to the automotive industry, including accelerating design and testing through rapid prototyping using 3D-printed models. Furthermore, it empowers manufacturers to produce customised spare parts according to their needs.

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.