German machine tool industry reports subdued annual results for 2024

By Staff Report March 4, 2025 6:49 pm IST

No increase in momentum is expected until the second half of the year, when it is anticipated that lower inflation and interest rates will support a recovery in investment.

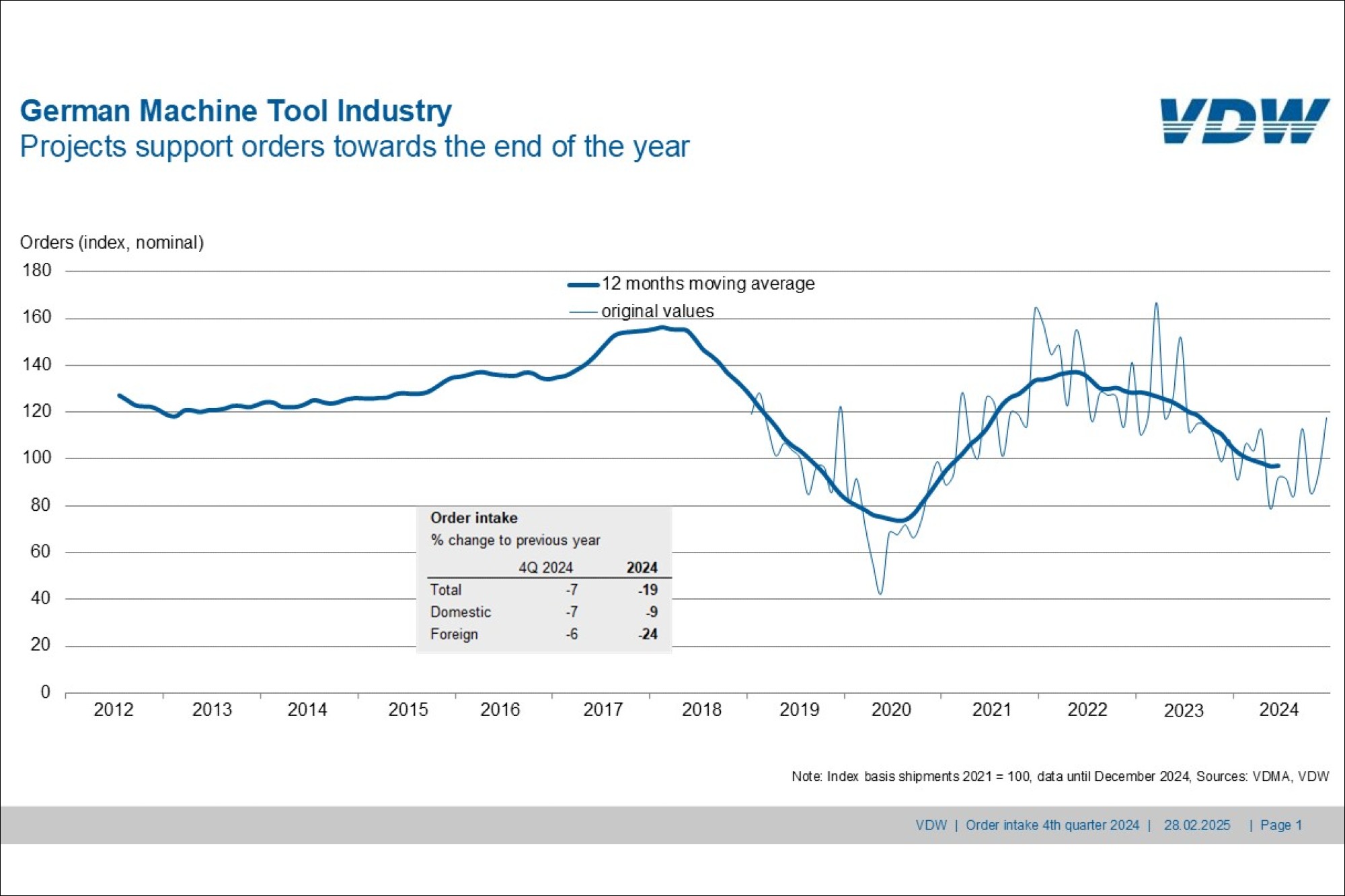

Orders received by the German machine tool industry in the fourth quarter of 2024 were 7 percent down on the previous year’s figure. Orders from both Germany and abroad fell by similar amounts: 7 percent and 6 percent, respectively. In 2024 as a whole, incoming orders declined by 19 percent. Domestic orders were 9 percent down on the previous year, while orders from abroad fell by 24 percent.

“The situation remains challenging for our industry,” says Dr. Markus Heering, Executive Director of the VDW (German Machine Tool Builders’ Association) in Frankfurt am Main, commenting on the result. The US market offers great opportunities for German manufacturing technology, which is regarded as indispensable, yet Trump’s tariff policy harbors high risks, Heering continues. The ongoing turbulence in the global economy, including the threat of a trade war, is having an impact on the overall willingness to invest. The critical situation in the automotive and supplier industry is a particular burden. Nevertheless, Heering reports that there are also some glimmers of hope on the horizon – in the fields of aviation, medical technology, precision engineering, energy, shipbuilding and armaments, for example, which have accounted for a number of major orders in the past. Business in such areas as service, components, repairs, maintenance and conversions is also stronger than that in new machine sales. However, order volumes fell by a quarter in all regions of the world last year.

“We expect the new German government to provide clear support in meeting all the points that the industry has been making for months now: cutting red tape, reducing costs, boosting competitiveness and investment activity, to name just the most important demands,” says VDW Executive Director Heering.

The impact of the two-year decline in orders received is now being felt in machine tool production, too. Here, levels continued to fall by a moderate 4 percent in 2024. A sharp decline of 10 percent is expected in 2025.

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.