Machine Tools Industry To Emerge Stronger

By OEM Update Editorial July 2, 2020 11:19 am IST

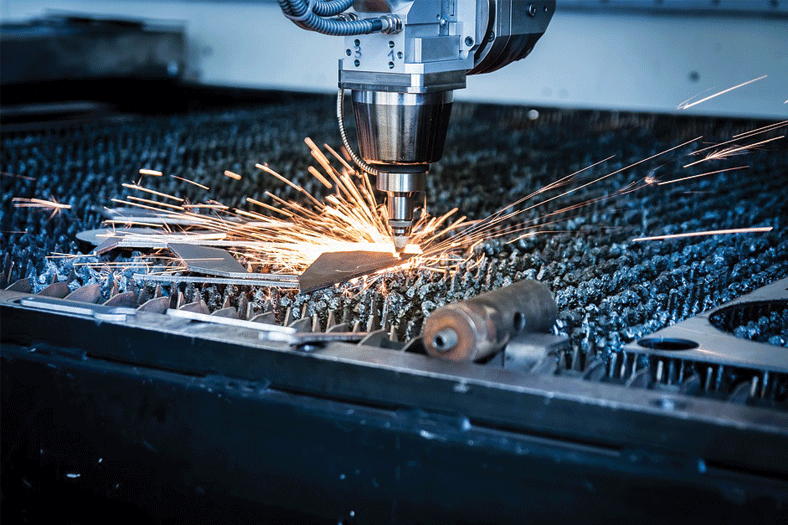

Though the prolonged slowdown in manufacturing sector has severely hit the machine tools industry, experts believe a better future lies ahead as the economy emerges from the clutches of COVID-19.

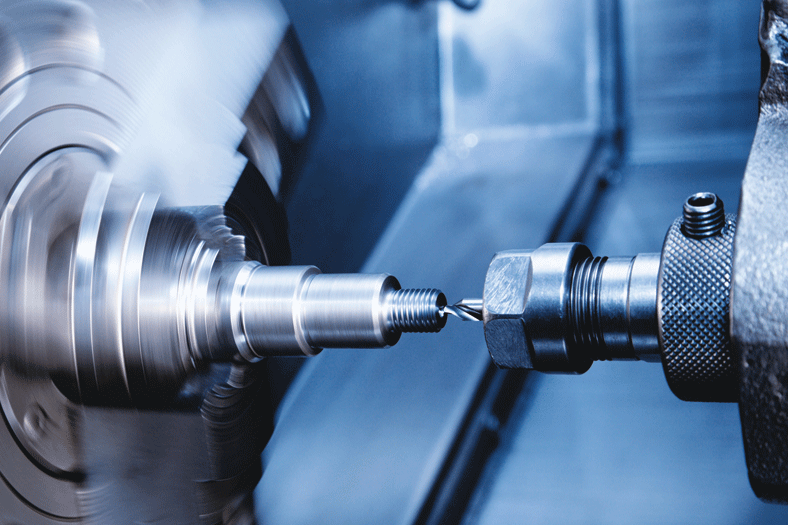

Machine tools industry is a critical part of the manufacturing sector. The machine tools industry in India has been serving the need for manufacturing through the production of machine tools, accessories/attachments, subsystems and parts. As per the 2017 Gardner Business Media survey, India stands 12th in production and 8th in the consumption of machine tools in the world.

The spurt in manufacturing due to increased industrialisation is driving the growth for machine tools sector. Due to this, several overseas companies have entered the Indian machine tools sector either by setting up wholly owned subsidiaries or through joint ventures. Today, the Indian machine tool industry has around 1,500 units across the country.

However, as per industry data, high-end machine tools are still majorly imported in India. It is estimated that India imported machine tools valued at around Rs 24,700 crore during the fiscal year 2019.

Of late, the Indian government has announced “Mission Atmanirbhar Bharat” to reduce the country’s dependence on imports. Talking about the approach of Indian industry in terms of reducing import dependence and encourage localised manufacturing, GK Pillai, Director & Advisor, Walchandnagar Industries Ltd., Pune said, “Indian industry and particularly the machine tools sector had all along been ready to play its role in reducing the country’s dependence on imports particularly in the manufacturing sector. However, all these years there has been a lack of impetus from the government for local manufacturing. It is really encouraging to see the government now embarking upon the ‘Atmanirbhar Bharat’ in addition to ‘Make in India’ programme on account of which local manufacturing will get a lot of encouragement and impetus.”

He adds, “The Indian manufacturing sector is ready to accept the country’s need of the hour and I am confident the Indian industry has the capability and expertise to manufacture various items in the country and reduce the dependence on imports.”

However, V. Anbu, Director General and CEO, Indian Machine Tool Manufacturers’ Association (IMTMA) and BIEC acknowledges that global manufacturers are ahead in technological knowhow, capacity, efficiency, volume and cost competitiveness. “Investments play big role in high-end technology and large-size machines. Indigenous technologies are being developed through ongoing projects at IIT Madras and CMTI, Bangalore. Manufacturers are also exploring joint ventures for technology transfer to reduce dependency and promote ‘Make in India’, he said.

Jayashree S Mani, Vice Chairperson at Guindy Machine Tools Ltd, also admits: “As far as machine tools go, a large percentage of the electronics are imported and although a few of them have factories in India, the technology is not developed here. Nor is their full range of products for high-speed and high-precision applications available here. Countries like Japan and Germany and even China are very far ahead in the development of these products. It will be a challenge to suddenly commence development of these products.”

She continues: “This is because, anywhere, the market drives development. The Indian auto component industry is huge, but does not serve a highly sophisticated market. So this means that high-precision, high-speed machine tools are not required in large numbers. We did not initiate research and development in sophisticated equipment in a very concerted manner in the earlier decades after 1950 – we had no need to. It is exorbitantly expensive and at this point, individual players cannot do much. Individual companies or even a consortium of the larger ones, cannot financially sustain such an effort, as they will not get returns from the market. So if we want to make precision equipment, we just import parts, like the angular contact bearings, tapered roller bearings, LM guides, controllers and software. Globalisation has made this easy for us. True development calls for an enormous market, coupled with government, academia and industry collaboration.”

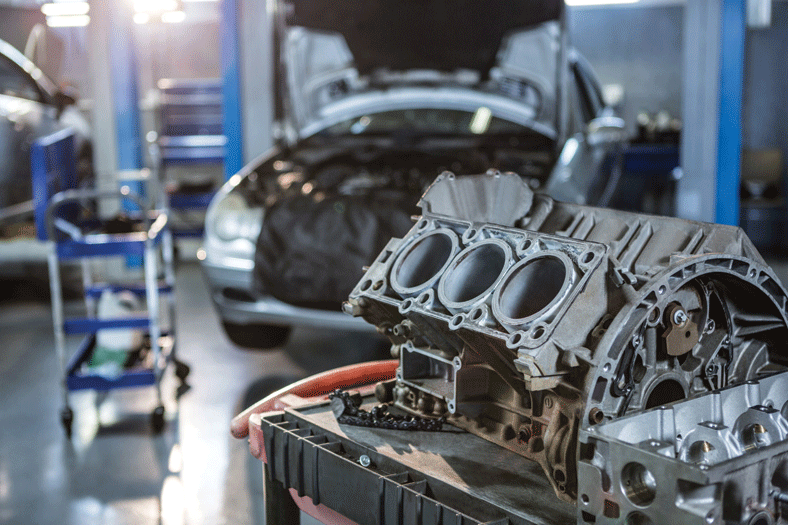

Impact of auto sector slowdown on machine tools industry

Today, the world is grappling with uncertainties due to COVID-19 pandemic. As India continues to fight its battle against this deadly virus, the industrial and economic activities are getting severely impacted due to prolonged lockdown. The Indian automobile industry that was experiencing a slowdown for almost a decade is the worst affected.

Highlighting the impact of auto sector’s slowdown on her company’s business, Jayashree said, “It is the components industry which affects us more. This has grown at about 16 percent YoY (Year over Year) over the last three years. About 85 percent by number of one-off customers in our customer-base are from the auto components industry. This has reflected in a significant increase for us.”

Pillai further explains: “The slowdown of the auto sector in any country has a cascading impact on the overall manufacturing sector. This has therefore impacted the Indian manufacturing sector and machine tools industry in a big manner. We supply a lot of castings and instrumentation gauges to the auto sector and the machine tools sector. The slowdown has also impacted us a lot.”

However, Anbu indicates a different aspect. He said, “Auto sector was having tough time with slowdown in demand for new vehicles, shift to BS-VI norms and advent of electric vehicles. This put pressure on machine tool business which depends on auto sector to a large extent.”Post-lockdown, in Anbu’s opinion, there has been a surge in demand for two-wheelers which is expected to trigger a turnaround for auto sector and support machine tool industry business.

Industry reactions on policy measures announced recently

According to Pillai from Walchandnagar Industries Ltd., Pune, “The Government of India has come out with a very elaborate economic package to offset the effects of the COVID-19 related lockdown. The redefinition of the MSME, financial assistance to the MSME sectors, giving impetus to local manufacture in the ‘Atmanirbhar Bharat Abhiyan’, opening up many more sectors to the private sectors and restricting the role of public sectors only for very strategic sectors are some of the measures which will help the manufacturing sectors to grow substantially.”

However, he opines, one area where the government can play an important role in the increased indigenisation of machine tools sector – it should ban the import of second hand machine tools which has been damaging the Indian machine tools industry for a long time.

Jayashree of Guindy Machine Tools observed: “Our fortunes are tied in with the automobile and auto component industries. Any policy changes reflecting in the growth of these industries give us a fillip. During the COVID-19 crisis, policy changes are not going to immediately reflect in vehicle sales. While 85 percent of our customers are directly from the auto industry, a handful of critical customers contribute to 60 percent of sales by value – these are the lathe manufacturers. They too benefit from policy changes which result in the growth of the vehicle industry, and our benefit is therefore two-fold. We believe that being forced to work with a reduced workforce during the crisis will also force us to review production methods and processes in the long term, resulting in greatly increased efficiency.”

Anbu anticipates: “Although the government has announced some support measures for MSMEs to address liquidity, it will take some time for banks to pass on the loans to the MSMEs. Industries are getting back to recovery mode and we shall foresee demand for goods and services picking up over the long-term.”

Revival Mantra

The post lockdown situation is going to be very challenging for most of the industries in the manufacturing sector. Walchandnagar Industries has been fortunate that the company has a township of its own where most of their employees are staying and hence they have been able to start manufacturing actions in a reasonable manner. However, according to Pillai, the challenge is more with regard to supply chain issues as lot of material has to be received on time for completing the manufacturing activities. “Also, there will be a great shift in the culture of the manufacturing industry and the employees have to be geared to work under these new normal norms. For this we are also taking our workers union representatives into confidence and they are also extending their cooperation to meet the production schedules in the new normal,” he added.

Further, Walchandnagar Industries is looking at diversifying into areas where there will be more demand post COVID-19 scenario, informs Pillai.

Jayashree said, “As suppliers of auxiliary equipment, we are dependent on the primary markets bouncing back. We continue to get enquiries through the COVID-19 crisis, albeit in much smaller numbers. As we serve a niche market, we are confident that we will bounce back with the markets during recovery. The market has not lost confidence in either us or our products. Many customers have sent enquiries saying they are prepared to ride through delays due to COVID-19. In the meanwhile, we have ofcourse, the usual plans in such situations, of reducing stock first, streamlining inventory etc. Our concerns are more directed to maintaining employee morale during this time.”

Being the apex industry body for machine tools sector, IMTMA is helping companies to regain market confidence post the lockdown. IMTMA has conducted several webinars for member companies and tried to create awareness on the various government measures besides advocating with the government on various policy issues. “Efforts are on to tap sectors such as railways, aerospace, medical equipment, etc. Industry has to strengthen its R&D, enhance technological capabilities, reorient market strategies, expand their range, and equip workforce with requisite skills. This will enable the machine tool industry to re-emerge as a spine for various sectors and the economy,” said Anbu.

True development calls for an enormous market, coupled with government, academia and industry collaboration.

Jayashree S Mani, Vice Chairperson, Guindy Machine Tools Ltd

Post-lockdown there has been a surge in demand for two-wheelers which is expected to trigger a turnaround for auto sector and support machine tool industry business.

V. Anbu, Director General & CEO, IMTMA & BIEC

It (the Govt) should ban the import of second hand machine tools which has been damaging the Indian machine tools industry for a long time.

GK Pillai, Director & Advisor, Walchandnagar Industries Ltd., Pune

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.