A closer look at the Indian textile machinery manufacturing

By Staff Report August 1, 2025 7:07 pm IST

Indian textile machinery manufacturers are integrating automation, artificial intelligence (AI), and smart manufacturing techniques to improve efficiency, reduce costs, and enhance product quality. They are using Industry 4.0 technologies, such as the Internet of Things (IoT), data analytics, and robotics, to optimise production, monitor performance, and predict equipment failures.

N D Mhatre, Director General (Tech), and Omprakash Mantry, President (2025/26) at Indian Textile Accessories and Machinery Manufacturers Association (ITAMMA), share that now robots are assisting with fabric cutting, sewing, and dyeing, while automated systems are handling quality control and inspection. AI analyses data to predict failures, optimise energy use, and tailor production schedules, with AI-powered vision systems ensuring consistent quality by detecting fabric defects. Additionally, digital technologies such as ERP systems and blockchain solutions are used to facilitate collaboration and streamline operations.

Can you share specific innovations or breakthroughs by Indian manufacturers that are setting new benchmarks in textile machinery performance or efficiency?

N D Mhatre, Director General (Tech), ITAMMA – Indian textile machinery manufacturers are making strides in innovation, with companies like Reshmi integrating IoT into their machinery, providing real-time performance monitoring and enhanced operational efficiency, as seen in products like Ultiflex and Precithread. Clifton Export has adopted Industry 4.0 by investing in auto-cutters and semi-robotic stitching machines, and is committed to achieving carbon neutrality. It offers “Green Tag” labels that display the carbon footprint of each product.

JUMAC (INDIA), Ji+ is an IIoT-based Silver Management System that enables last-mile traceability, data-backed automation and centralised control. They have smarter spinning mills, with decision-making tools and increased DATA transparency. Also, according to a recently published report, implementation of the latest Internet of Things (IoT) tools can improve mill productivity and time-to-market by up to 25%.

Rimtex provides Silver Loading Technology, specifically in their Sumo Mini cans, that boosts productivity by increasing silver yield per can by over 10%, without requiring any changes to existing machinery, equipment, or silver can dimensions. This innovation has also proven beneficial for the open-end spinning segment, enabling up to 10% more sliver space within the same can size, optimising both capacity and efficiency.

The SliverBot is an Autonomous Mobile Robot (AMR) designed for smooth and hassle-free transportation of large-diameter sliver cans. It reduces manual labour, minimises human error, and cuts down on production downtime to improve efficiency and profitability. Built with an innovative X-Axis design, it offers a fresh approach to component selection by combining Xtensa Rings and Xgen Travellers for good yarn consistency. Supporting this system, Kalpar’s single-axle castor wheels are engineered to prevent dirt and fluff from collecting on the wheels. This ensures continuous, stoppage-free movement of the cans, protects the sliver from breakage during transport, and reduces the need for frequent manual cleaning.

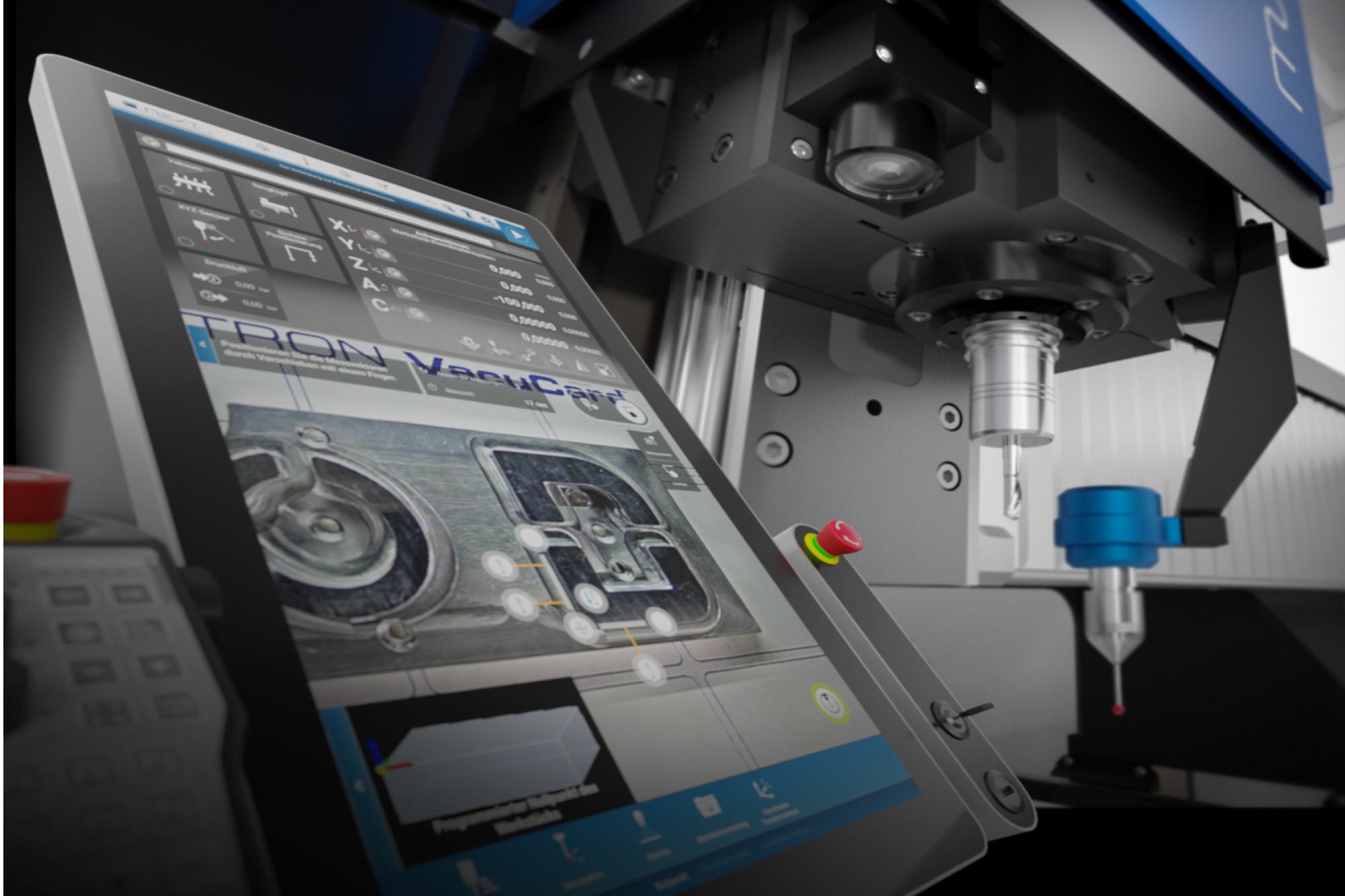

(Image 2)

Despite being a major textile-producing nation, India still imports a significant portion of high-end textile machinery. What is stopping us from becoming self-reliant in this segment?

India’s textile machinery sector lacks the sophisticated technology and R&D ecosystem necessary to produce high-end machinery competitively, and it has inadequate access to funding. Tax structures, such as excise duties on raw materials and a lack of exemptions on finished products, can increase costs and discourage local manufacturing. The textile industry, particularly in the power loom and handloom sectors, struggles to adopt and invest in new technologies due to a lack of funds and a perception of high risk.

India relies on imported speciality fibres, which further exacerbates the need for advanced machinery and technology. Access to financing, particularly for small and medium-sized enterprises (SMEs), is a significant constraint to upgrading machinery and adopting new technologies. Many textile units still operate with older, less efficient machinery, limiting their ability to compete in the global market. In line with the Technology Upgradation Fund Scheme (TUFS) and ATUFS, more targeted support and policy interventions are needed. Improving market access and enhancing the competitiveness of Indian textile products through innovation and sustainability initiatives is crucial for long-term growth.

What machinery is imported, and what measures are taken to produce them indigenously?

India imports various textile machinery, with printing machines, especially those capable of multiple functions and inkjet printing, being among the highest imported commodities.

Textile winding machines are the most imported, with imports totalling US$291.90 million, witnessing a growth of almost 40% in 2023. Cotton yarn winding machines alone were imported worth US$187.98 million, showing a growth of 29.28% in 2023.

To promote indigenous production of textile machinery in India, a multi-pronged approach is being implemented. This includes government initiatives like the “AatmaNirbhar Bharat” (Self-reliant India) program, encouraging collaboration with Indian manufacturers, offering financial incentives, and providing technical support. Additionally, policies such as reducing import duties on raw materials and components, as well as promoting R&D in textile engineering, are being implemented. Production Linked Incentive (PLI) Scheme offers incentives to domestic manufacturers to encourage increased production and exports. The Ministry of Textiles has launched the Prime Minister’s Initiative for Textiles (PM MITRA) scheme to develop seven textile parks across the country with world-class infrastructure and technology.

What are the most pressing challenges that Indian textile machinery makers face when competing with established global players, such as those in Germany, Japan, or China?

Indian textile machinery makers face significant challenges when competing with established global players, primarily due to factors such as outdated infrastructure, a lack of technology adoption, and fragmented supply chains.

Many Indian textile mills operate with old machinery and lack modern production facilities, hindering efficiency and competitiveness. There’s a slow pace of technology adoption and limited research activities in the Indian textile industry, leaving it behind in terms of innovation and automation. Our textile industry is characterised by a decentralised and fragmented supply chain, making it difficult to achieve economies of scale and compete globally. Factors like high power costs, inefficient logistics, and outdated infrastructure contribute to higher production costs for Indian textile manufacturers.

Indian manufacturers face strong competition from countries like China, Bangladesh, and Vietnam, where production costs are lower due to cheaper labour and government subsidies. The industry struggles with labour shortages and a lack of skilled workers, making it difficult to operate modern machinery and improve productivity. The textile industry’s impact on the environment is a growing concern, adding pressure on manufacturers to adopt sustainable practices and technologies. Limited investment in modernisation and technology adoption, coupled with the high cost of capital, hampers the industry’s ability to compete globally.

With growing pressure on sustainable manufacturing, how are Indian machinery manufacturers redesigning or re-engineering machines to reduce energy consumption and waste?

Indian machinery manufacturers are redesigning and re-engineering machines to reduce energy consumption and waste by incorporating technologies like AI, lean manufacturing, and renewable energy sources, while also focusing on resource efficiency and waste minimisation through circular economy principles.

Technology integration is happening with Machine Learning (ML) and Artificial Intelligence (AI) used to optimise machine operations by continuously adjusting parameters and settings. AI-powered predictive maintenance helps prevent costly breakdowns and extends the lifespan of equipment, reducing the need for replacements. Lean manufacturing methodologies aim to eliminate waste throughout the production process, improving resource utilisation and reducing energy consumption.

Manufacturers are adopting energy-efficient machines and utilising renewable energy sources, such as solar panels and wind turbines. Additive Manufacturing technology reduces material waste by building components layer-by-layer, unlike traditional manufacturing processes. Implementing circular economy practices promotes recycling and reuse, extends product lifecycles and conserves resources. Water management improves water quality and reduces water usage through efficiency measures, while material management reduces the use of hazardous materials and optimises material flow. Redesigning press tools and machines is producing less scrap and improving scrap collection and recycling processes. Focusing on efficient design and manufacturing processes minimises energy consumption and material waste.

Critical items of parts and accessories like compact spinning attachment, automatic yarn splicer, PLC controls, dedicated components for shuttleless looms, electronic controls for high speed shuttleless looms, electronic dobby, electronic jacquards, microprocessor and PLC controls for warping and sizing machines, hi-tech temperature indicator and controller worth Rs. 1500 cr. are imported out of total import of Rs. 6500 Cr. (textile machineries & parts). This gives a clarion call for development to happen under the Make in India initiative.

How ready is the domestic workforce to operate and maintain advanced textile machinery, and what steps are being taken to close the skill gap?

The Indian textile industry, though large and diverse, faces a significant skill gap in operating and maintaining advanced textile machinery, particularly in technical textiles. This is due to the increasing sophistication of equipment and the need for specialised personnel, especially in areas like Meditech, Agrotech, and Indutech. Various initiatives are underway to address this, including specialised training programs, apprenticeship schemes, and government policies like the National Technical Textiles Mission and the Skill India Mission.

The skill gap in the Indian industry is due to the rapid advancements in technology and the need for specialised personnel to handle sophisticated equipment. To address this, the government, industry bodies, and educational institutions are collaborating on various skill development programs, including training initiatives like Samarth, ISDS, and the General Guidelines for Skill Development and Training in Technical Textiles, which aim to train a large number of individuals.

The textile industry’s growth, especially in technical textiles, is outpacing the supply of skilled workers who can operate and maintain advanced machinery. This includes expertise in areas such as digital technology, automation, and the maintenance of advanced equipment. The retirement of experienced workers also contributes to the skill gap, particularly in traditional textile segments. The Indian government, through initiatives like the Skill India Mission, Pradhan Mantri Kaushal Vikas Yojana, and the National Skill Development Corporation, is actively promoting vocational education and training.

The Textile Sector Skill Council (TSSC) is developing industry-aligned curricula, providing training programs, and implementing certification schemes. Educational institutions, such as ATIRA, NITRA, BTRA, SITRA, and NIFT, as well as industry bodies, are collaborating to create specialised curricula, industrial training programs, and apprenticeship programs. The Technical Intern Training Programme facilitates skilled worker exchanges between India and other countries, allowing for international exposure and skill transfer. Training programs are increasingly incorporating basic training, advanced technologies, managerial abilities, and digital literacy. International Certification Programs are incorporating certifications mapped to international qualification frameworks to enhance global employability. Initiatives like the National Technical Textiles Mission (NTTM) are targeting high-growth areas within the technical textile sector, such as Meditech, Agrotech, Indutech, and others. The establishment of regional training hubs for MSMEs addresses skill gaps at the local level. Strategies such as workplace-based learning, knowledge transfer, upskilling and reskilling, and continuous learning will help bridge the gap. However, challenges such as rapid technological changes, inadequate infrastructure, changing workplaces, and the retirement of skilled workers persist.

========================================================

What is ITAMMA’s roadmap for positioning India as a global hub for textile machinery manufacturing in the next five to ten years?

Omprakash Mantry, President (2025/26), ITAMMA – We have a mission of ‘Zero–Harm Culture in Manufacturing’, where our focus is to help association members move towards sustainability and minimise environmental impact, promote ethical labour practices, and foster a circular economy.

We are living in the world of generative AI. Every business now uses digitalisation for product development and business information to be active in this challenging global market. We at ITAMMA are also taking efforts to prepare our members for making businesses in this smart world, through a dynamic website equipped with a business and technology enabler platform and a smart DATA clinic. We encourage our members to embrace technological developments by connecting them with academicians during the B.K. Mehta Technology Networking Mission. This event connects academicians, industry experts, industrialists and government bodies. We further strengthen this initiative through a dedicated Technology Development Fund and by recognising the contributions of our members with awards such as ‘Make-in-India’, ‘Environment-Friendly’, and others that celebrate innovation and impact.

Members are also given exposure to state-of-the-art infrastructure and world-class operational systems through regular visits to leading organisations such as SITRUST – the Global Skill Centre for Occupational Safety, Siemens, Gold Seal – SAARGUMMI India Pvt. Ltd, and LMW.

With man-made fibres (MMF) now dominating global textile fibre consumption in a 72:28 ratio compared to natural fibres, the growing demand for MMF textiles presents both opportunities and challenges. This calls for our members to be prepared when designing and manufacturing machines and accessories for MMF applications. We regularly connect them with industry stalwarts through seminars, conferences, and knowledge-sharing platforms.

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.