Harnessing newer technologies can transform machine tools sector

By OEM Update Editorial April 2, 2021 7:50 am IST

Discussing the present industrial trends, leading die and moulds experts suggests to have a positive approach towards newer technologies as they can potentially transform the entire outlook of machine tools sector.

The tooling industry plays a key role in the manufacturing value chain by providing dies and moulds needed for mass production of various parts, forming the backbone of industrial growth. The market size of the tooling industry in India is estimated to be `18,000 crore with 70 percent of demand being met domestically and 30 percent from imports. Tooling imports into India are about five times the exports from the country by value with China and Korea accounting for almost 40 percent of the total tooling imports.

Considering that the CAGR for Automotive, Aerospace, Consumer Goods and Electrical & Electronics for the next 5 years are projected between 5 percent and 27 percent, the outlook certainly is positive! Of course, until now, the die and mould industry has consistently grown in double digits and if the same trend continues, we should hit or exceed the projected growth rate.

Present market trends for Die and Moulds

India’s tooling industry is estimated to grow up to `26,000 crore in value by 2025 on back of strong growth in key end-user segments. In terms of key end-users of the Indian tool room industry, the automotive segment is expected to grow 8 percent, consumer durables 9 percent, plastics 12 percent, electronics 14 percent and electrical by 21 percent over the next five years.

Inverted duty structure, challenges in access to finance and lack of skilled workforce are some of the key challenges ahead of the industry and it needs government support to address these hurdles. On this note, Rajesh Nath, Managing Director, VDMA India, says “To help reduce imports and make India an export hub for the tooling sector, government intervention is critical in helping to set up clusters and large-scale institutes for development and localisation.”

According to Vineet Seth, Managing Director – South Asia & Middle East, Mastercam APAC, one of the recent reports stated, currently, the Die and Mould market in India is estimated to be closer to 2.5 Billion US dollars. It is expected to grow by another 1.5 billion additionally in the next 5 years. “I consider the number optimistic, in order to achieve such high growth, which is roughly 10 percent CAGR for the next five years, demand across industries that lean on the Die and Mould industries should also grow proportionately, if not more”, he adds.

Innovations in die and moulds sector

The Die and Mould making industry in India has evolved over the years and today competes in a global arena. With an increasing demand from industries such as automobiles, auto components, packaging, plastics, electronics, electrical, healthcare and machine tools, we see a huge opportunity in the Die and Mould making industry in India.

Around 43 percent of the total Indian tooling market is plastic moulds, closely followed by sheet metal dies. Experts believe that the growing usage of plastics in various industries and shift from sheet metal component to plastics in segments like automotive, consumer appliances and electronics has resulted in the rising demand for plastic moulds.

Tools are needed in all the sectors. However, the requirement may change depending on the sector. Some may demand high precision, exotic materials and less in quantity or some may need large moulds and bulk quantity. “Automotive being the prime driver of the tooling industry, with many changes and uncertainties, will continue to rule the business for tool makers”, says Nath. However, there are other industries also that are emerging to be growth drivers for component suppliers.

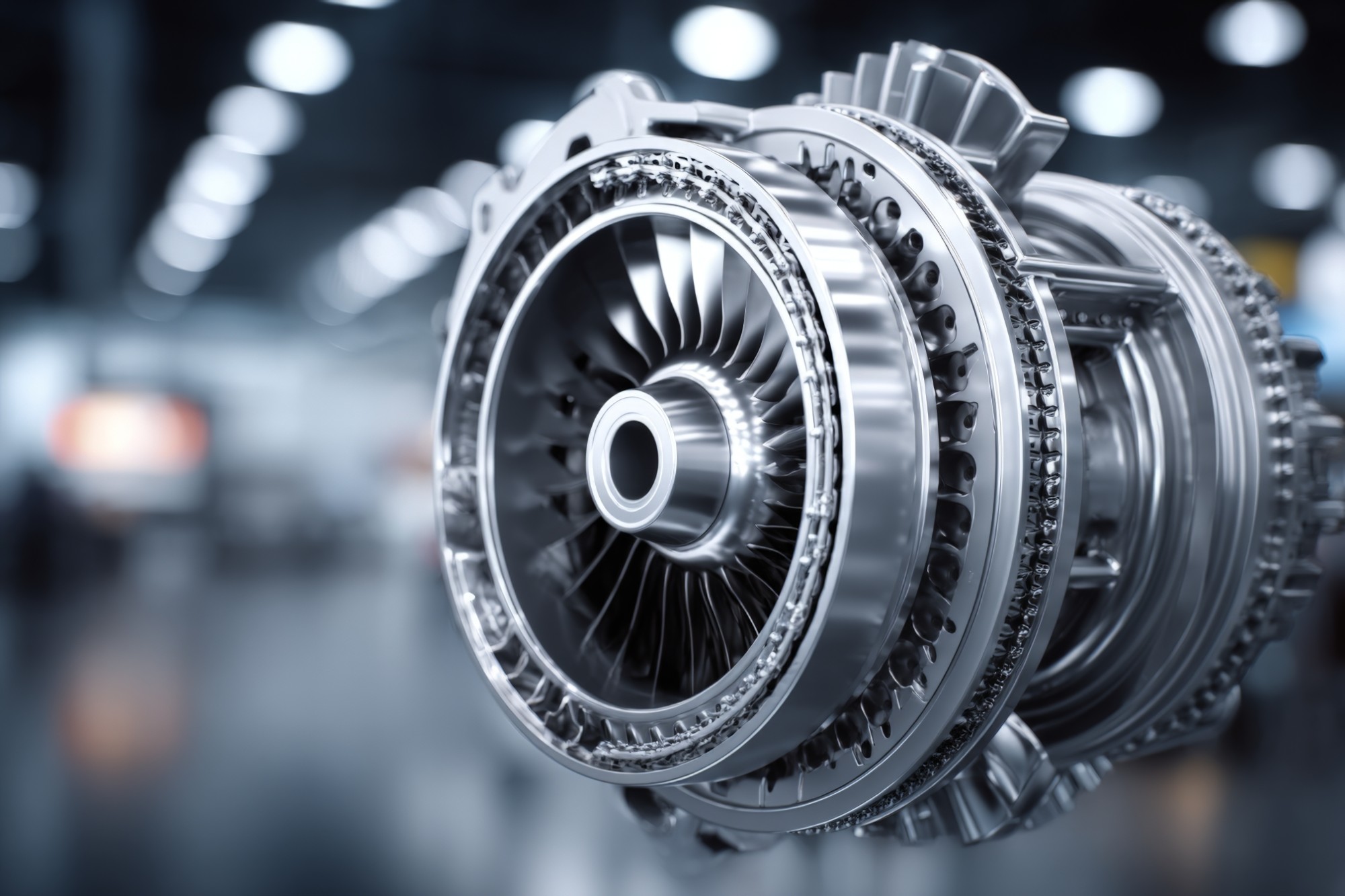

Whereas, Seth feels that adoption of high-tech manufacturing at the D&M toolrooms are catering to newer opportunities in manufacturing. Since precision manufacturing is the mantra of toolmakers, it is significantly easier for them to cater to the high-tech requirements of the Aerospace and Defence requirements.

Dealing with existing and expected challenges in the sector

We all know disruption is happening very fast – the biggest consumer of die mould industry – Automotive – that consumes 70 percent of tools globally, is going through a sea of change. Electric vehicles, weight reduction and autonomous cars are taking shape faster than expected. Time-to-market for automotive OEMs have come down drastically, that means we need to be more efficient to deliver tools faster with higher accuracy while keeping the cost low.

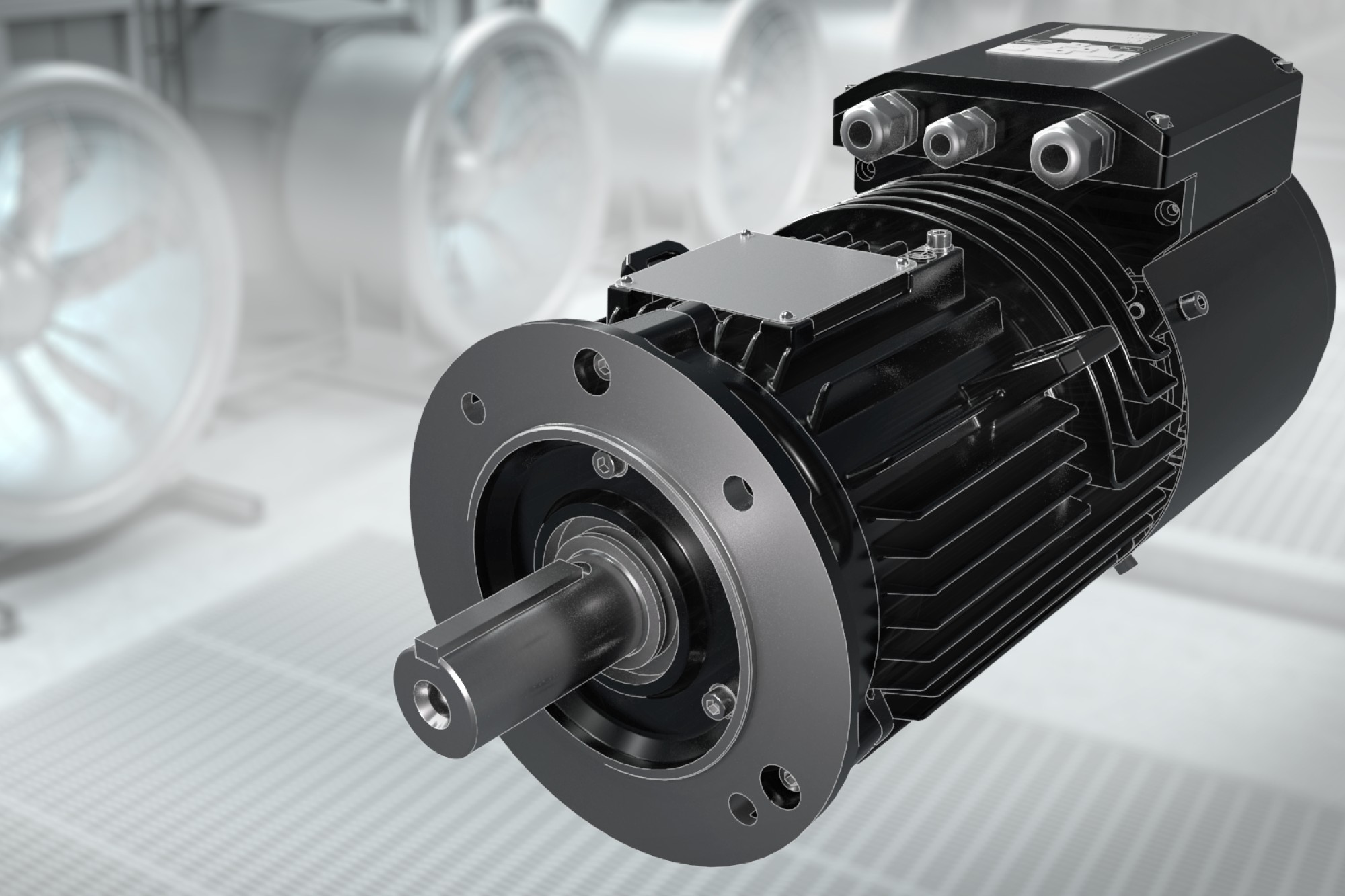

Also, the industry must dare to take bold steps and discard what is not future-proof. Here, Nath suggests that industry must harness the core values of technologies, like additive manufacturing (AM), to move towards new ways of thinking and doing that have a meaningful impact.

Opportunities for domestic and localised manufacturingThe COVID-19 pandemic has adversely impacted the global supply chain and affected the functioning of businesses across various sectors. Tool makers are finding it challenging to deal with this crisis. For instance, owing to low order volumes and holding off on new development projects from OEMs and Tier-1 companies, toolmakers are currently grappling with excess capacity and financial management.

Indian tool makers lose out to their global competitors because, in most cases, they are not equipped to meet the tooling demands. Here, Nath suggests that the Indian toolmakers need to join hands and focus on improving their processes to match the standards of other dominating tooling industries across the world. “Also, the industry must explore alternative ways to enhance their productivity. For instance, they should consider investing in design automation, high-end machining processes, better manufacturing process and measurement capabilities”, Nath adds.

In order to reduce the imports of Dies and Moulds which are about four times the amount that we export, “we need to build a Die Mould Ecosystem that is organised, considers and nurtures the mutual growth and interdependence of small to large toolrooms, and at the same time – suppliers to consumers (OEMs)”, says Seth.

Promoting innovation within this ecosystem, will then benefit all players. A breakthrough in a specific parameter, process or application, will add value to both the upstream and downstream channels. Once this is accomplished or in play, the industry will then be able to create opportunities not only for localised production of Dies and Moulds but to also create a formidable “Made in India” brand in the global arena.

Industrial leanings

Technology trends such as IoT, Industry 4.0, Big Data, Artificial Intelligence will be key in coming days for any manufacturing setup. A production environment which is backed by data, driven by intelligent technologies can help companies enhance productivity by predicting possible outcomes like breakdown etc and reduce wastage and save time. Our technology adoption rate must be faster in future.

“This is certainly a time of uncertainties; however, we must be ready for such scenarios. Die mould is considered as the mother industry, which means its needed everywhere”. He further adds that we must enhance our capabilities and capacities to reduce the imports.

Considerations

There are a number of development projects in play at the moment, both government and non-government. Metro, infrastructure, highways, Smart Cities to name a few and the advent of certain global giants who are eyeing the manufacturing space in India to locally manufacture their products are high up from the point of view of business generation for the Die and Mould sector. TAGMA, the apex body of tooling manufacturers in the country are working with the Government of India to help boost the Die and Mould sector in the country, by liaising with the officials and discussing high level policies.

The government and OEMs need to work together to develop clusters for the tooling industry. There is a need for revising curriculum in tool training institutes and introducing advanced courses on tool engineering and also for setting up of dedicated R&D institutes specific to the die and moulds sector. There can be technical tie ups and collaborations with overseas tool rooms/training institutes for sharing knowledge and best practices.

Vineet Seth, Managing Director – South Asia & Middle East, Mastercam APAC

Adoption of high-tech manufacturing at the D&M toolrooms are catering to newer opportunities in manufacturing.

Rajesh Nath, Managing Director, VDMA India

Industry must harness the core values of technologies, like additive manufacturing (AM), to move towards new ways of thinking and have a meaningful impact.

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.