Machine tool industry expecting no upturn until next year

By Staff Report August 12, 2025 11:34 pm IST

German machine tool orders stagnate in Q2 2025, with domestic decline, foreign growth, and recovery now expected only by 2026.

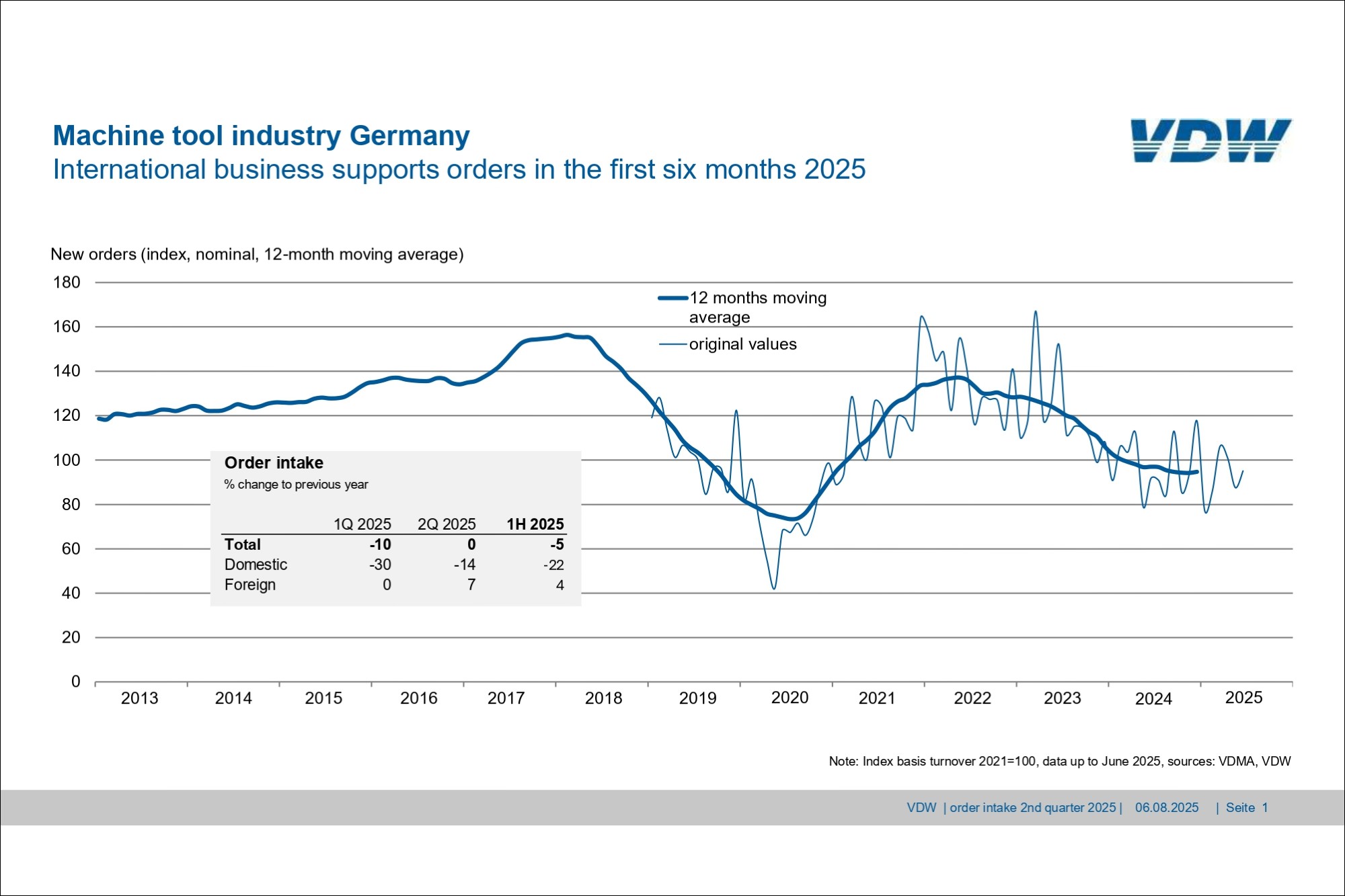

Orders received by the German machine tool industry in the second quarter of 2025 remained at the same level as in the same period of the previous year. Domestic orders fell by 14 percent, while orders from abroad rose by 7 percent. In the period from January to June 2025, orders fell by 5 percent. Domestic demand fell by 22 percent, while foreign orders were up 4 percent on the previous year.

“The main impetus in the first half of the year came from Europe, although demand levels have not yet picked up in the domestic German market,” says Dr. Markus Heering, Executive Director of the VDW (German Machine Tool Builders’ Association) in Frankfurt am Main, commenting on the result. The ongoing uncertainty caused by the US tariff policy and the many other crises is causing investors to take a wait-and-see approach. While the recently negotiated tariff rate of 15 percent applies, this will increase costs and significantly inhibit German exports to its largest market, the US. “US industry urgently needs our machines because no comparable domestic alternatives are available, yet small and medium-sized US companies in particular will not be able to pay the higher prices,” says Heering.

By contrast, the medium-term outlook in Germany is brightening. The approved increase in spending on defence and infrastructure, as well as the recently adopted investment package, could noticeably raise consumers’ willingness to make new purchases. In any case, the ifo business climate index is signalling improved sentiment in the German manufacturing industry. The international Purchasing Managers’ Index PMI also shows that the slump in the industrial sector is bottoming out. Nevertheless, this is not the hoped-for turnaround.

“The recovery of the machine tool industry has been put back once again,” explains Heering. “We do not anticipate a return to stable growth until 2026.” Domestic demand in particular is expected to provide a boost, while foreign business is likely to be weaker than previously expected. “The tariff policy of the US is harming its economy the most, which will not provide any great impetus shortly,” says Heering.

Sales of machine tools in the first six months of this year were down 9 percent. Nevertheless, the sector is eagerly awaiting the EMO 2025 in September. “More than 1,500 exhibitors will be presenting a whole range of innovations designed to raise their customers’ competitiveness. We are expecting this to provide crucial impetus,” concludes Heering.

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.