Securing the future of machine tools in a changing landscape @EMO Hannover

By Staff Report September 23, 2025 3:27 pm IST

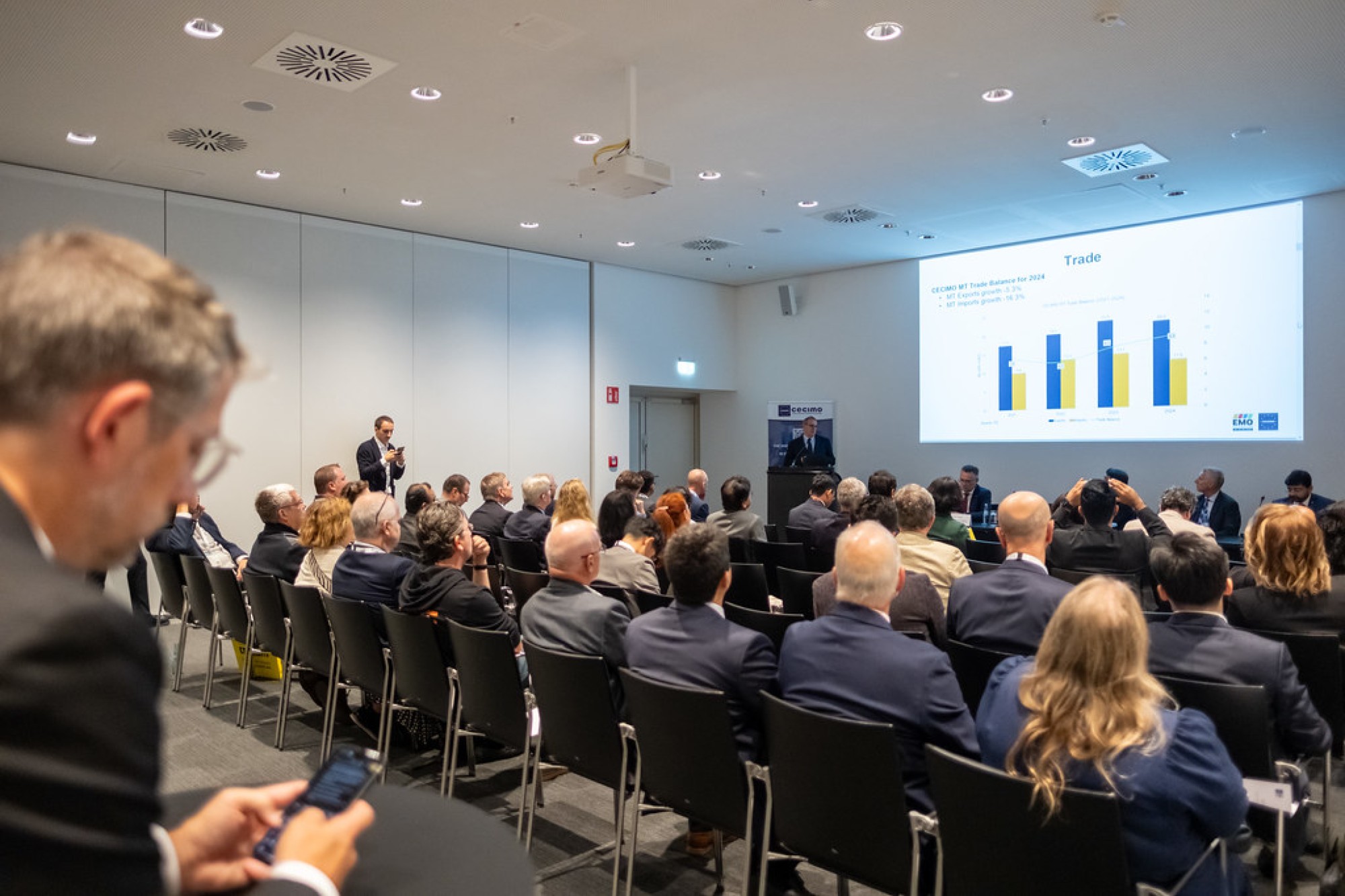

EMO 2025 became a stage for unity as machine tool associations from across the globe came together to highlight the sector’s critical role in shaping the future of manufacturing. Despite facing geopolitical uncertainty and economic challenges, EMO 2025 showcased the machine tool sector’s capacity to adapt and to innovate. Facing diverse conditions for 2024 and 2025, industry representatives stressed that continued progress would rely heavily on joint initiatives, creative solutions, and flexible strategies to ensure long-term growth.

“Despite regional differences, we share common goals: creating a better business environment, expanding global markets, tackling skills shortages, and driving innovation through green and digital technologies.” Highlighted François Duval, CECIMO’s President, in his opening remarks at the CECIMO’s Press Conference at EMO Hannover 2025, as during the event were present representatives of the Indian, American and Japanese machine tools sectors.

Mr Marcus Burton, Chairman of CECIMO’s Economic Committee, presented key insights on the Machine Tool market that could not have been produced without strong cooperation among the National Associations organised by CECIMO. Mr Burton underlined how European Machine Tools (MT) production decreased by 9.2% to 25.1 billion EUR in 2024 from 2023. Recent projections estimate a further decline of around 8.6% in 2025 compared to 2024. Because of this estimation, the world share of European MT production is predicted to drop to 31.5% in 2025 (compared to 34% in 2024). Looking at consumption levels, CECIMO countries witnessed a 16% decrease in consumption in 2024, and projections point to a further drop of around 3.6% in 2025.

The Order trend for the CECIMO 8 countries has reflected the economic challenges, with the results for Q2 2025 showing a decrease of 2% quarter on quarter. However, the CECIMO8 order index was 6% YoY higher than in Q2 2024, based on improving foreign orders. In his concluding remarks, Mr Burton highlighted that “even though the results for the last two years represent a negative outlook heavily impacted by geopolitical, trade and economic uncertainties, the year ahead (2026) is expected to deliver stronger results driven by the anticipated increase in order and consumption levels”.

In reference to the Japanese machine tools sector, Kazuo Yuhara, President of Japan’s Machine Tool Builders’ Association (JMTBA), pointed out how “domestic demand decreased by 7.4% compared to the previous years and how overseas demand increased by 3.4%”. He presented how production of metal cutting machine tools shrank by 14.3% from the previous year in 2024, accounting for around 901.3 billion yen, below 1,000 billion yen for the first time in three years. In addition, a decline in overall trade data has been recorded regarding the export and import of metal cutting machine tools. As a matter of fact, export data was 8.3% down from the previous year, while import levels went down by 11.5% in 2024. To conclude, Mr Yuhara highlighted the mixed results registered by the initial forecast for 2025 and the current situation. The initial forecast for 2025 projected strong order activity. In the first half of the year, total orders and exports rose year-on-year, while imports declined.

During his presentation, Douglas K. Woods, President of AMT – the Association for Manufacturing Technology in the USA, emphasised the strong domestic consumption growth in 2024 compared to 2023 (an expected increase of around 12%). Woods highlighted how this surge is mainly driven by increased demand across aerospace, defence, the reshoring of influenced sectors and by the impact of Foreign Direct Investment. Looking ahead to 2026, AMT expects a stable environment (even though a slight decline in orders is expected). For instance, Mr Woods pointed out how: ”The observed softness likely reflects greater caution due to elevated financing costs, uncertainty over trade policy, persistent geopolitical risks, and a potential saturation effect after several years of sustained investment”.

Regarding the Indian MT sector, Jibak Dasgupta, Director General & CEO of the Indian Machine Tool Manufacturers’ Association (IMTMA), highlighted the increasing importance of India. For instance, the Indian expansion can be observed by its GDP, reaching $4.19 trillion in current prices, recording 6.5% real GDP growth in FY 2024-25, and how it is projected to grow at the same pace until 2029. Mr Dasgupta described the remarkable growth of the Indian machine tool industry with a total consumption of USD 3.7 billion in FY 2024 – 25. ”The automotive and auto component sector is currently the leading consumer, accounting for nearly 50% of the demand. However, sectors like general engineering, Die & Mould, construction and farm equipment remain significant MT purchasing sectors”. To conclude, Mr Dasgupta pointed out the opportunities that India represents in terms of international collaboration and investments.

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.