Similarly to the internet, where data, designs, and decisions move freely across borders, time zones, and teams, the supply chain provides the foundational platform for the global movement of goods, services, and value. Just as the internet connects billions of users into a unified network, a seamless supply chain has the same effect in global manufacturing. In this feature, industry leaders share their insights on building efficient and resilient supply chains, as well as the roadblocks that still hinder progress.

The manufacturing sector is no stranger to disruption, but the last few years have exposed deep vulnerabilities in global supply chains. Whether it was semiconductor shortages stalling auto production, port congestion delaying critical machinery, or geopolitical tensions reconfiguring sourcing maps, supply chains are no longer back-end functions; they have become boardroom priorities. Today, supply chain resilience, visibility, and agility are as crucial to manufacturers as quality and cost control.

The COVID-19 pandemic revealed significant vulnerabilities in global supply chains, particularly within Global Value Chains (GVCs). Lockdowns, border closures, and social distancing measures resulted in widespread disruptions to the production and movement of goods. The interconnected nature of GVCs meant that shocks in one part of the world quickly spread throughout the chain, causing ripple effects globally. For example, the electronics sector, heavily linked to Chinese production networks, experienced a sharp decline of up to 40% in value-added during the pandemic’s peak. The crisis reduced physical output and eroded trust in the reliability of international supply chains, especially since just-in-time models and lean inventory systems left little room for safety buffers. Businesses faced challenges in coordinating across borders due to communication breakdowns and a lack of cooperation during the height of the pandemic.

According to the Global Value Chain Development Report 2021 – Beyond Production by the WTO, China’s central role in global supply chains, particularly in the decade leading up to the pandemic, exacerbated these issues. Between 2005 and 2016, China emerged as the dominant global supplier, surpassing countries like Germany and Japan in many complex production networks. This dominance created concentration risks, as numerous economies became heavily dependent on Chinese inputs. While this dependency was advantageous during stable periods, it became a liability when Chinese production was disrupted, as observed in early 2020.

Beyond pandemics, environmental risks are also increasingly threatening supply chains. Many industrial clusters are located in vulnerable regions, such as coastal zones, floodplains, and areas prone to typhoons and earthquakes, making them more susceptible to the impacts of climate change and natural disasters. Disruptions can occur directly, through damage to capital and infrastructure, or indirectly, through interruptions in logistics and upstream inputs. These indirect effects are particularly damaging in industries that rely on complex component supply chains, such as semiconductor manufacturing and automotive production. Lean manufacturing and just-in-time systems further exacerbate these vulnerabilities by limiting inventory and redundancy.

Risks to supply chains have become compound rather than isolated. Rajesh Nath, Managing Director of VDMA India, shares that events such as COVID-19, U.S.–China trade tensions, and climate-related disasters now occur simultaneously, amplifying their individual effects. For OEMs, this means rethinking procurement strategies, diversifying supplier bases, and relocating critical operations closer to end markets—a trend often referred to as “friend-shoring” or “nearshoring.” For instance, the global semiconductor shortage in 2021 was not solely due to pandemic-related shutdowns. It was also attributed to severe winter storms in Texas and fires in Japan. These events highlighted the interconnectedness of global production and how easily supply chains can be destabilised. In response, businesses are increasingly adopting strategies like geographic diversification, nearshoring, and digital transformation. The focus is shifting from cost efficiency to resilience, with more companies investing in “just-in-case” capacity, regional hubs, and redundancy.

Challenges

Geopolitical tensions are disrupting global trade and supply chains, increasing costs, delaying shipments, and forcing companies to reassess their sourcing strategies. Conflicts, sanctions, and regulatory changes are fragmenting supply networks while rising cyber threats add further risk. Ravikiran Pothukuchi, India Manufacturing & New Domains Sales Director, Brands (Enterprise Apps), Dassault Systèmes, India, shares that in response, businesses are turning to regional supply chains, diversifying their suppliers, and investing in digital technologies for better visibility and resilience.

Regulatory complexity also presents challenges, as each country has its own evolving rules for imports, exports, and compliance. In India, new BIS quality control orders have introduced mandatory certification standards for many products, complicating compliance, especially for small and medium enterprises (SMEs) that often lack the resources to track these changes.

Cybersecurity is another growing threat. It now impacts operational safety, product quality, and customer trust. In a global supply chain, even minor data breaches can have severe consequences, resulting in production delays and a loss of client confidence.

Inventory management remains critical as companies strive for a just-in-time model while maintaining sufficient safety stock to avoid delays caused by late shipments or quality issues. Many companies that produce customised products face these challenges while balancing the need for minimal inventory with the risk of delays associated with insufficient stock.

Lastly, communication and cultural differences among global teams can hinder alignment. Ultimately, success depends on adaptability, flexibility, and creating strong systems around our people and processes.

Policies

From a policy perspective, the WTO report suggested that moving towards autarky or complete self-reliance is inefficient and impractical. Instead, policies should aim to create resilient, diversified supply networks that span multiple countries and regions. This includes strengthening digital infrastructure, enforcing antitrust laws to prevent over-concentration, and ensuring fair labour practices along the supply chain. Policymakers must also tackle broader systemic risks, such as geopolitical tensions and environmental degradation, by promoting transparency, equitable tax policies, and international cooperation. Therefore, building resilience is a business imperative and a challenge for global governance.

A Connected and Complex World

Globalisation is driven by advanced engineering, digital transformation, and the movement of capital and talent, steadily eroding traditional borders. The United Nations Conference on Trade and Development (UNCTAD) reported that global trade in goods and services reached a record $32 trillion in 2022 but slowed to around $31 trillion in 2023, according to early 2024 estimates.

For India, this shift presents a historic opportunity. As global companies reconfigure their supply chains for resilience and geopolitical balance, India is emerging as a preferred hub for manufacturing, sourcing, and innovation in high-precision sectors such as aerospace, defence, and energy systems.

India’s rank in the World Bank Logistics Performance Index (LPI) 2023 improved to 38, a six-place leap from 44 in 2018, driven by investments in digital infrastructure and policy reforms. India’s supply chain management market generated approximately $833 million in revenue in 2023 and is projected to grow to around $2.4 billion by 2029 at a compound annual growth rate (CAGR) of 15.6%, according to industry forecasts.

The growth of the manufacturing sector in recent times has made it the fifth-largest manufacturing economy globally, according to 2023 data from UNIDO and the World Bank. A large, skilled engineering workforce drives this growth, along with strong domestic demand, enabling policy frameworks such as PLI, Make in India, and Aatmanirbhar Bharat, as well as strategic investments in digital infrastructure and smart logistics.

This hyperconnected environment brings risk. As seen during the pandemic and recent geopolitical disruptions, a single point of failure—a chip, a regulation, or a shipment delay—can trigger ripple effects across continents.

Smart supply chains are no longer just connected—they are orchestrated. The frontier lies in building an adaptive, data-driven ecosystem where suppliers, OEMs, logistics players, and governments work in real-time sync. This requires cross-vertical collaboration across manufacturing, logistics, technology, and finance, all supported by digital platforms and data-sharing agreements that provide transparency and agility.

A 2024 McKinsey & Company survey noted that over 90% of global supply chain leaders now prioritise talent and digital capability as core to future readiness. For India, this is a competitive advantage waiting to be scaled—through skilling, co-innovation, and trusted long-term partnerships. The future of supply chains is defined by the ability to build intelligence, efficiency, and trust across the entire value chain rather than just within borders.

India’s position as a global supply chain catalyst

India is now the fifth-largest global economy in terms of nominal GDP and an emerging vital hub in the worldwide supply chain. GS Selwyn, Executive Vice President of Rolls-Royce India and Managing Director of MTU India, shares the pillars for navigating the borderless supply chain.

Keeping borderless supply chains smart, efficient, and resilient

Building supply chains that are smart, efficient, and resilient is a strategic imperative. These pillars are interconnected and essential for navigating the complexities of the global landscape.

Being smart is about synchronised intelligence. Technology and data must enhance visibility, predictive foresight, decision-making, and autonomous execution. Data and digital technology have the power to solve complex challenges. Embracing digital technologies, such as the Internet of Things (IoT), digital twins, blockchain, and cloud computing, enhances traceability, simulation, and communication across borderless supply chains. Industry 4.0 introduced automation and data exchange; Industry 5.0 advances the model with a focus on human-centric, sustainable, and collaborative systems. This creates intelligent, efficient, adaptable, ethical, and resilient supply chains for a future marked by disruption.

Efficiency transcends cost savings. It’s about seamless flow, interoperability, and responsiveness across global systems. Smart route optimisation software determines the most efficient travel routes, considering factors like fuel consumption, traffic, and weather. Modular and flexible manufacturing, paired with logistics management, allows supply chains to scale with demand and shift geographies with minimal friction.

Resilience is no longer optional—it’s a competitive advantage. It means designing supply chains that bend without breaking. Globally, companies are diversifying suppliers, adopting multi-sourcing, exploring front-shoring, and investing in localised production. Apple’s recent expansion of iPhone manufacturing in India is a prominent example.

Internal collaboration is crucial to building supply chains that are truly smart, efficient, and resilient. Products must now be designed for reuse, remanufacturing, and recycling. Supply chains should be looped, sustainable, and self-correcting. The next frontier of global commerce is defined by the seamless flow of value across functions and partners rather than the distance goods travel. We must evolve from managing supply chains to orchestrating supply chain ecosystems—prioritising smart technologies, operational efficiencies, robust resilience, and cross-vertical collaboration.

Global trade in 2025 is projected to undergo significant transformations, influenced by a range of factors, including geopolitical tensions, tariffs, growing sustainability demands, and rapid advancements in artificial intelligence (AI). Zurvan Marolia, Senior Vice President, Godrej Enterprises Group, suggests that India urgently needs to prioritise its AI strategy, as the technology is poised to revolutionise trade logistics, supply chain management, and traditional trade patterns.

Balancing localisation and globalisation is a strategic imperative. It involves tailoring products and services to local needs while maintaining a cohesive global brand identity. As industry professionals, it’s our responsibility to embrace this new era of international collaboration and build a better ecosystem. Let’s work together to create a world where goods are designed, produced, and delivered with speed, efficiency, and quality—ensuring borderless supply chains are smart, efficient, and resilient.

————————————————————————————————————————————————————————————————————————————————————–

GS Selwyn, Executive Vice President, Rolls Royce India and Managing Director, MTU India

We source various aerospace components from Indian partners like Bharat Forge, Godrej & Boyce, and Tata. Hundreds of Trent engine parts are made in India. This deep engagement drives innovation, builds capability, and supports India’s ambition for greater self-reliance in manufacturing and technology—aligned with Atmanirbhar Bharat.

Ravikiran Pothukuchi, INDIA Manufacturing & New Domains Sales Director Brands (Enterprise Apps), Dassault Systèmes, India

With AI-driven part standardisation, businesses can identify alternative components and suppliers, reducing dependency on single sources. Virtual twins of factory systems perform real-time simulations and reschedule operations, ensuring agility in the face of unforeseen disruptions. This is critical in regulated sectors, such as aerospace, where export controls and localisation policies influence sourcing.

Zurvan Marolia, Senior Vice President, Godrej Enterprises Group

Agility and Risk Management are at the heart of our approach to process management. Our SBUs remain vigilant to changes in external developments and respond with timely changes to ensure the uninterrupted flow of inward and outward movements in the supply chain.

Rajesh Nath, Managing Director, VDMA India

Businesses are shifting from a centralised, efficiency-driven model to a decentralised, risk-mitigated structure. Scenario planning, geopolitical risk assessments, and increased investment in digital supply chain visibility are now also core to strategic decision-making.

Ashish Aggarwal, Chief Administrative Officer, Cummins India

We design, engineer, and manufacture a wide range of products in India for both local and global markets. Our glocalisation strategy uses India’s supplier network to source critical components for supply chain resilience. This approach ensures a robust supply chain and builds partnerships with local vendors.

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.

Mastercam’s platform is designed to be hardware-agnostic and workflow-consistent, enabling OEMs to replicate proven workflows across regions. Vineet Seth, Managing Director for South Asia & the Middle East at Mastercam APAC, explains that while what works for a machine in Germany may not work in India, and Mastercam’s consistent workflow helps bridge that gap.

How is Mastercam supporting global OEMs in harmonising machining operations across different regions where skill levels and infrastructure vary?

Harmonising machining operations across borders, variations in skill levels, machine availability, and infrastructure often lead to inconsistencies in part quality and production efficiency. We bring real value as software and as part of a larger ecosystem designed for global scalability.

Our key strength lies in the people behind the brand. Across regions, we have invested in building strong local teams who speak the language, understand the shop floor reality, and work closely with customers to align expectations with delivery. These aren’t just sales teams; they’re technical professionals who support everything from training to custom post-development.

Working with machine tools, controllers, and cutting tool partners, we help OEMs run with accurate post-processors, tooling libraries, and validated workflows. This partner-driven approach ensures that the software integrates into a wide range of production environments, whether it’s a high-end 5-axis cell in Germany or a mid-sized machining centre in Southeast Asia.

Our MConnect strengthens the standardisation effort by enabling seamless information exchange between various departments in the organisation. These tools help bridge communication gaps, track data, and maintain process control across locations. Perhaps most harmonisation is achieved through a combination of robust templates, best-practice workflows, and structured training. By embedding standardisation into the programming process and reinforcing it through continual learning, we guarantee that OEMs can maintain quality and repeatability worldwide, regardless of the manufacturing location of the part.

With many OEMs shifting toward localised production hubs, how does Mastercam adapt its solutions to the diverse needs of markets like India, Vietnam, and Mexico?

As global OEMs decentralise production and move closer to end-use markets, the manufacturing narrative will rapidly shift from “scale” to “agility”. India, Vietnam, and Mexico are emerging as sophisticated, responsive hubs in the global supply chain. And with that comes the need for our CAM platforms that are adaptable and deeply rooted in local realities.

Localisation involves ensuring software compatibility with the machines, tools, and skill levels available in the market, not just focusing on language packs. We achieve this through strong collaborations with local machine tool builders, controller OEMs, and cutting tool companies. Pre-configured post processors, tool libraries, and proven templates make adoption faster and more reliable, even in smaller or less automated shops.

In India and Vietnam, the market’s talent pools are ambitious but still maturing in digital manufacturing. We support intensive skilling initiatives by partnering with technical institutes, running certification programs, and enabling curriculum development that feeds directly into production readiness.

What role does CAM software play in helping manufacturers achieve faster design-to-part turnaround times in the face of global supply chain uncertainties? How does this differ across industries?

In today’s volatility, uncertainty, complexity, and ambiguity (VUCA) world, swift design to finish transition is no longer a competitive advantage but a business imperative. Our CAM software plays a central role in enabling agility by removing the friction between engineering intent and manufacturing execution.

Our CAM platform allows manufacturers to build intelligent, repeatable workflows through automation, templates, and integrated verification. This means fewer manual interventions, faster programming, and fewer iterations on the shop floor—all of which translate into turnaround times.

The CAM platform varies across various industries, including aerospace, where tolerances are tight and geometries are complex. The emphasis is on precision, multi-axis programming, and simulation fidelity. CAM here needs to be deeply integrated with complex post-processors, tooling strategy, and machine kinematics. In the automotive industry, where the focus is on speed and volume, the need is for process standardisation, automation, and minimal setup times. Templates, batch processing, and rapid toolpath regeneration become critical. Pharma and FMCG tooling often serves packaging and mould components; the emphasis is on fast iterations, clean surface finishes, and rapid changeover areas where our automation and efficient 2D/3D workflows play a key role.

The ability to simulate, verify, and virtually prove a process before touching the machine has influenced manufacturers’ planning and response. Our CAM has become the digital glue that holds together design responsiveness, production reliability, and operational efficiency, particularly in challenging supply chains and timelines that are non-negotiable.

Skill development remains a key challenge in many emerging markets—how is Mastercam contributing to closing the digital skills gap for machinists and engineers worldwide?

Addressing the skills gap is a foundational part of sustainable manufacturing growth. In India, where the potential workforce is large but digitally underprepared, we actively worked at the grassroots level to close this gap. Our ITI initiatives, through partnership with the Tata Group, have enabled hundreds of training centres with industry-grade software and certified curricula. These programs are designed to equip students with practical skills for the job, not just theoretical knowledge.

Its easy, intuitive interface, visual workflows, and logical toolpath structure make it approachable even for first-time users. Learners find it easy to grasp the fundamentals, and educators find it easy to teach – a critical advantage when scaling training in high-volume environments.

All our major manufacturing processes, 2- to 5-axis milling, turning, wire EDM, turn-mill, and complex mill-turn, are accessible within a single interface. Students don’t need to switch between systems to build competence across different machining platforms. This unified experience accelerates learning and builds confidence.

We have a global install base that students trained on the platform are instantly employable locally and anywhere skilled machining is valued. It’s the alignment between education, technology, and industry relevance that makes the difference.

From your perspective, what are the most pressing challenges in creating a truly borderless digital manufacturing platform, and how is Mastercam addressing them?

Creating a borderless digital manufacturing platform requires much more than just technology. At its core, ensuring that design intent, process logic, and production reliability travel seamlessly across geographies, machines, and teams. The biggest challenges lie in interoperability, people, process maturity, and standardisation.

Different regions come with vastly different levels of infrastructure, skill, and machine capability. What works effortlessly in a Tier 1 plant in Germany may require rethinking in a midsize facility in Mexico or India. Language, training, and access to service support add further complexity.

Our platform is designed to be hardware-agnostic and workflow-consistent. Whether programming a 3-axis machine in Pune or a 5-axis mill-turn in Ohio. Through a single interface, users can access everything from basic milling to multi-axis and complex turnmill operations, ensuring that part programs are transferable, repeatable, and scalable across all operations.

Standardised templates, process libraries, and powerful post-processor capabilities enable OEMs to replicate proven workflows across regions. Our MConnect supports the digital thread by communication across design, programming, and the shop floor, helping teams stay aligned regardless of location.

Beyond the software, our strength lies in a global network, localised teams, native language support, and relationships with machine and tooling partners. This allows us to adapt to local realities while maintaining global consistency. Borderless manufacturing isn’t just about moving files. It’s about moving capability. And with the mix of flexible technology and strong local engagement.

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.

OEMs are pushing for faster, greener, and smarter production systems, and Marposs enables manufacturers to meet these expectations while maintaining cost efficiency. Luca Matteucci, Marposs’s Managing Director, discusses how the company adapts its manufacturing and quality control solutions to diverse regulatory and technical standards.

How do you support global OEMs in maintaining consistent quality and compliance across diverse regional markets?

We adapt by offering modular, customisable solutions that align with local regulations and technical standards. Our global network ensures compliance and provides technical support in every market we serve.

We support OEMs in regional hubs by providing our localised engineering, technical support, and standardised solutions to ensure consistent quality and performance across global production sites.

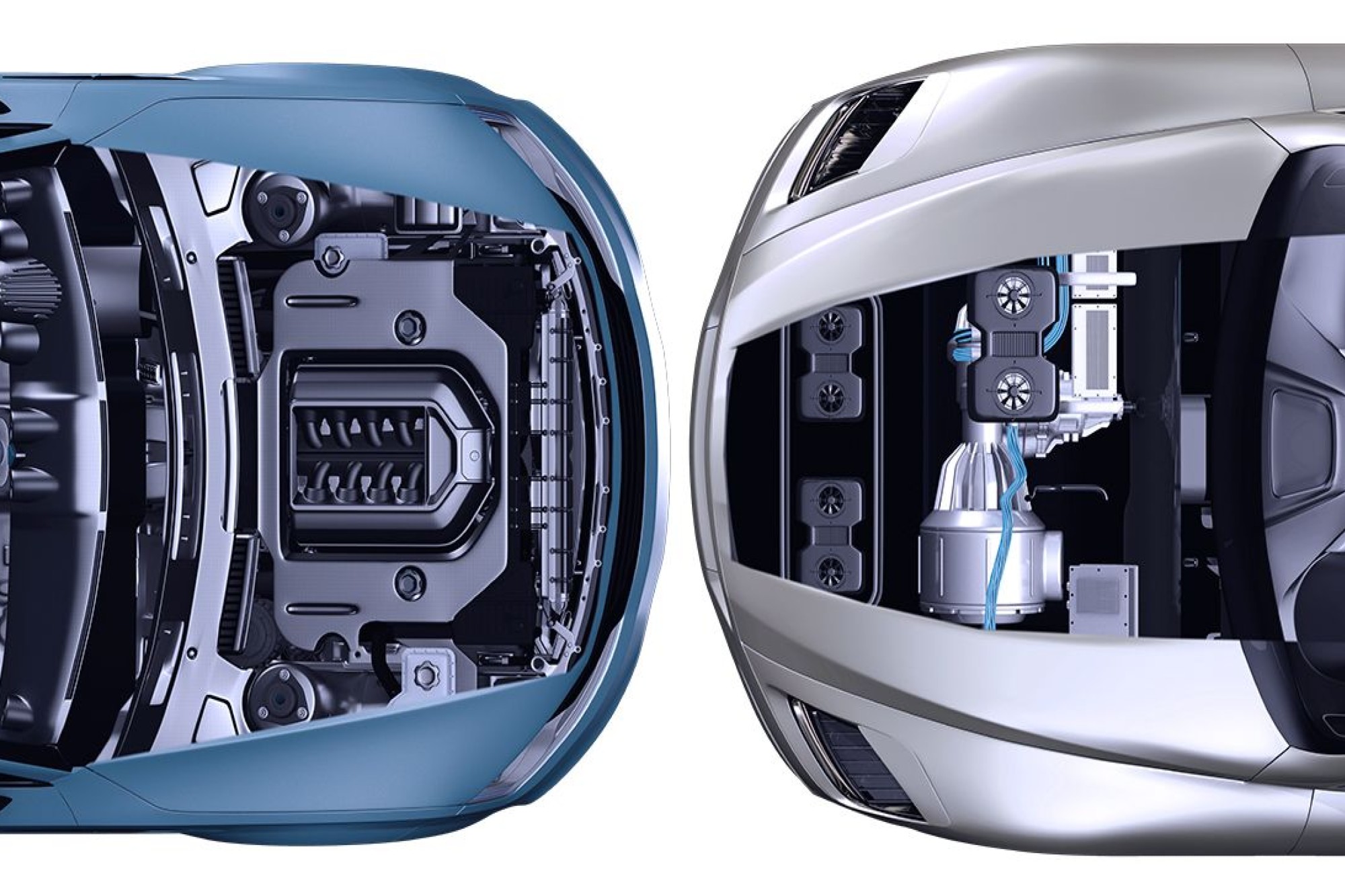

We collaborate with global OEMs by co-developing adaptable measurement and inspection technologies that address the unique requirements of ICE and EV platforms, ensuring cross-platform compatibility and seamless integration.

What strategies has Marposs implemented to ensure supply chain resilience in the face of shifting geopolitical landscapes and trade restrictions?

We enhance supply chain resilience amid geopolitical shifts by diversifying our operations across India, Vietnam, and Mexico, thereby reducing our reliance on any single market. We are establishing local production and providing support to adapt to regional disruptions. By utilising advanced data acquisition systems and industrial PCs, we maintain consistency and reliability across our operations. We aim to collaborate with suppliers and customers to enhance transparency and agility, and we stay informed about geopolitical developments to adjust our strategies and mitigate potential risks.

How does Marposs balance the need for global standardisation with localisation?

We balance our global standardisation with localisation by designing modular solutions that meet international standards while tailoring configurations, support, and services to local market needs through our worldwide network of subsidiaries and partners.

How does Marposs accelerate cross-industry innovation globally?

We leverage our global footprint by connecting R&D centres, local teams, and industry experts worldwide to share insights, accelerate innovation, and adapt solutions for aerospace, automation, electric vehicles, energy, consumer durable semiconductors and more.

How is Marposs helping manufacturers meet OEM goals for faster, greener, smarter, and cost-efficient production?

We enable manufacturers to meet faster, greener, and smarter production goals by integrating advanced automation, real-time data analytics, and energy-efficient technologies while optimising processes to maintain cost efficiency.

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.

Mahr’s core design philosophy is scalability, with Shaft Measurement Machines accommodating contact and non-contact measurement technologies for unprecedented flexibility. Deepayan Das, Managing Director of Management at Mahr Metrology India Private Ltd., discusses their MarWin software platform that is compatible with all advanced measuring systems.

How does Mahr ensure its products remain adaptable to various industries and applications, especially in emerging manufacturing hubs such as India and Vietnam?

Adaptability is engineered into our core design philosophy. We achieve this through modular design and scalability. With the growing demands and challenges our customers face, we have put extensive efforts into designing systems that are scalable in terms of capacity and capability, such as our Shaft Measurement Machines, which can accommodate contact and non-contact measurement technologies to bring unprecedented flexibility.

One of the key strengths of the metrology solution is the foundation of powerful software capabilities. Our MarWin software is evolving with new capabilities and features to address unique and emerging application trends in manufacturing hubs in India and Vietnam.

What steps are you taking to ensure seamless support and availability of your products across different regions, given the increasing complexity of global supply chains?

Navigating complex global supply chains is a challenge. We’ve actively ensured uninterrupted support and product availability.

We operate strategically located logistics and warehousing hubs in our subsidiaries across different continents, including a robust network in Asia. We stock critical components, finished spare parts and accessories products closer to our customers. This reduces our lead times and mitigates the risks of global disruptions.

In India and Vietnam, we rely on a network of well-trained local partners and our service centres. We train our partners to handle common queries and requirements of our customers.

What technological advancements are you most excited about in metrology, and how is Mahr leveraging these innovations to drive better quality control for OEMs globally?

We are particularly excited about the global trend toward measuring precise, faster, and closer machines. We are constantly engaging our research team to meet these requirements and solutions, e.g., scatter light sensors, which is a recent development by us. This helps our customers to measure components with live feedback to the production machine, allowing for the correction of surface abnormalities such as chatter marks or undulations that directly impact the frictional properties of precision high-performance surfaces.

How are your tactile and non-contact measurement solutions different from others in the market, especially in terms of speed, accuracy, and integration with factory systems?

We don’t aim for speed; we go for precision at speed. Our solutions directly enhance manufacturing efficiency through a combination of proprietary technology and a focus on specific applications. Non-contact precision measurements come with their challenges, as measurements are prone to the cleanliness of the part surface. The combination of advanced optics and image processing algorithms with our legacy MarWin software streamlines the handling of these challenges.

With traceability in mind, our solutions are designed with Industry 4.0 principles. Our software is capable of reading and integrating data from barcode scanners, and our MarWin software platform is compatible with all advanced measuring systems. This provides seamless connectivity to factory systems, enabling real-time data exchange and remote monitoring, which significantly reduces downtime and reduces efficiency for OEMs.

What attributes and qualities in measurement impact the growth prospects of the measurement industry in India?

The demand for greater precision influences the growth prospects of India’s measurement industry. As India’s manufacturing sector rapidly advances towards aerospace components, electric vehicles, advanced electronics, and medical devices. The demand for increasingly higher precision measurements becomes non-negotiable. This fuels the need for advanced metrology solutions.

The push for industry 4.0 adoption across Indian industries means manufacturers actively strive for automated, integrated measurement solutions that can seamlessly connect to production lines. This reduces human error, increases throughput, and aligns with global manufacturing standards, driving demand for automated solutions.

The availability of skilled personnel who can operate, interpret, and maintain advanced metrology equipment is crucial for effective operation. Investments in training and technical education will directly impact the industry’s ability to adopt sophisticated measurement technologies and maximise the utility of instruments.

As Indian manufacturers aim for global markets, adherence to stringent international quality standards (e.g., ISO, IATF, ASTM) becomes critical. Robust measurement quality, assured by our certified Mahr calibration services and traceable instruments, ensures compliance and opens doors to global supply chains.

While global technology is essential, the ability of metrology providers to offer localised solutions, strong after-sales service, quick calibration, and readily available spares significantly impacts adoption and sustained growth in the Indian market.

Can you elaborate on how Mahr is integrating Industry 4.0 principles into its product offerings and how this is benefiting OEMs in terms of automation and smart manufacturing?

We are deeply committed to integrating Industry 4.0 principles, transforming our product offerings into intelligent, interconnected components of a smart manufacturing ecosystem. Our solutions are equipped with advanced interfaces for communicating with factory networks, ERP systems, and other production equipment. This is foundational for real-time data exchange across the production floor.

Even the smallest gauge Vernier calliper from us integrates an RF sensor, making it a powerful tool to measure and share results with any Windows- or Android-based software that uses predefined templates. Integrated with central servers, removing the complete need for manual data entry. Our MarWin platform is designed for intelligent analysis and visualisation.

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.

Global sourcing remains uncertain, and thus, localisation has gained momentum. Luxmi Trading is becoming a dependable partner that offers tailored components, domestic alternatives, and export-ready solutions for mission-critical industries.

How is Luxmi Trading addressing the challenges of fluctuating raw material prices and ensuring consistent supply for essential engineering components?

We deal with raw material price swings like most industrial buyers wish suppliers would — with deep product knowledge, real relationships, and on-the-ground hustle. When components become scarce or overpriced, we don’t just shrug. We go to factories, inspect machines, collect samples, and use our local and international network to find exactly what fits, both functionally and financially. A good example: a client’s machine was designed for Gates HTD timing belts but kept failing under load. Instead of blaming the machine or the spec, we sourced and delivered a Gates GT4 — a higher-grade, application-specific variant. The problem was solved, the machine was back up, and there were no recurring breakdowns. We stock smartly, anticipate demand from long-standing clients, and maintain direct lines with top-tier brands.

With increasing localisation efforts and reduced reliance on imports, how are you strengthening your domestic sourcing and supply chain partnerships?

We’re big believers in self-reliance. Over the years, we’ve built solid ties with domestic suppliers, MSMEs, and niche manufacturers, especially for critical components like valves, pipe fittings, and V-belts, where good Indian options are available. But localisation for us isn’t just a checklist. We test, verify, and stress-check every component before recommending it as a substitute for an imported one. Our responsibility begins right from sourcing. We ensure the quality is right, the specs match, and the machinery performs just as well (if not better). Where it makes sense, we blend sourcing — local for speed and value, global for precision or specific grades.

Are you exploring advanced materials or coatings in your product portfolio to improve durability and operational efficiency for heavy industries?

Yes — in demanding industries like steel, sugar, and mining, standard, off-the-shelf parts often don’t meet the harsh conditions. That’s why we specialise in supplying speciality bearings and power transmission components made from advanced alloys, high-temperature resistant coatings, and maintenance-free designs engineered to last much longer. We work closely with clients to identify the exact stresses and environmental factors their machines face—extreme heat, heavy loads, corrosive atmospheres, or constant dust and moisture. This helps us recommend or source custom-coated chains, stainless steel bearing units, and other tailored solutions that significantly reduce wear and tear. We focus on delivering smarter, more durable components that keep operations running smoothly and avoid costly breakdowns. Our clients operate their plants 24/7, so even a single hour of unplanned downtime can mean huge losses. We dig deep into performance data, factory visits, and real machine feedback to recommend the right parts for real-world conditions instead of supplying readily available components. This approach has often helped extend machinery life by months or years, drastically reducing maintenance frequency and unplanned outages.

In light of the increasing emphasis on sustainability, are there innovations in your fluid handling or transmission product lines that promote energy efficiency or reduce environmental impact?Sustainability is embedded in everything we do, day in and day out. In fluid handling, we guide clients towards upgrading their systems with tight-sealing ball valves and precision-engineered gaskets that drastically reduce leakages, prevent wastage, and improve overall system integrity. Regarding power transmission, we prioritise energy-efficient timing belts and low-friction V-belts that reduce slippage and vibration while extending the equipment’s operational life. This means less frequent replacements and lower energy consumption over time. Beyond parts, we understand the impact of lubricants and greases on sustainability. For instance, one plant initially asked for standard grease. Still, after assessing their operating conditions, we sourced Addinol lubricants from Europe, which are known for their high performance and long-lasting properties. This switch meant fewer applications, less product waste, and a reduced environmental footprint without compromising machine efficiency. These are not flashy “green” marketing campaigns — they’re practical, cost-effective improvements that help our clients cut down energy use, reduce maintenance frequency, and lower their overall environmental impact, all while keeping operations smooth and uninterrupted.

What strategic steps are you taking to expand your reach in high-growth sectors like mining, power, or defence, especially in export markets?

Our expansion strategy is rooted in one thing: being the supplier that industries call when no one else can deliver. Whether sourcing obscure, machine-specific parts, bridging logistical gaps, or navigating regulatory bottlenecks, we’ve built our name by showing up when it matters most. We’re an ISO-certified MSME with over two decades of frontline experience. We respond quickly and practice work standards efficiently enough for the large-scale operations demand, especially in mission-critical sectors like mining, power, and defence. For example, we’ve supplied rugged power transmission components built to withstand extreme environmental abuse and worked with engineering teams to tailor-fit solutions rather than dumping catalogue items. On the export front, we’re already filling critical supply gaps for overseas clients — especially those in politically sensitive or restricted trade environments. We recently supported a Russian industrial partner during a peak embargo period, ensuring uninterrupted supply when European sourcing was off the table. We did more than ship parts; we enabled continuity — and that’s the kind of partnership we aim to replicate across other high-growth, high-dependence geographies. We’re also investing in relationships with EPC contractors, international resellers, and defence OEMs looking for sourcing partners that bring genuine value, speed, and technical reliability. And while we scale outward, we’re keeping our ears to the ground — staying as committed to a 3-piece urgent delivery as we are to a full-scope procurement project.

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.

Jungheinrich AG is a German company that operates in the fields of material handling equipment, warehousing, and material flow engineering. In these areas, the company ranks second in Europe and third globally. Manojit Acharya from Jungheinrich explains how the company has achieved this esteemed position and continues to evolve by adopting innovative technologies to remain competitive in a dynamic market.

As supply chains become more regional and demand faster fulfilment, how is Jungheinrich adapting its material handling solutions for markets like India and Southeast Asia?

With the boom in e-commerce, retail, and quick commerce, increasing customer expectations for faster delivery, and the growing need for higher energy efficiency, safety, reliability, and productivity, warehouses must be equipped to meet customer demands with speed and agility. This demands better warehouse infrastructure, including high-quality flooring and advanced material handling equipment.

Jungheinrich understands this need well. We offer sustainable material handling solutions powered by state-of-the-art Li-ion battery technology, ranging from entry-level junior trucks, forklifts, and reach trucks to non-standard semi-automatic very narrow aisle trucks (VNA) that can manoeuvre in tight spaces and can be utilised for storage and retrieval at higher heights.

Our equipment enables stacking and retrieving pallets, as well as individual item picking, delivering impressive throughput and optimal space utilisation. These advantages are critical amid rising costs and demand for higher throughput.

We have a strong sales and service network and are continuously expanding our customer touchpoints to serve our customers more efficiently. Complemented by a strong partner network in India and Southeast Asia, we also provide timely support and customised solutions to enhance operational efficiency in these dynamic markets.

How has your factory setup evolved over the past few years as Industry 4.0 and its associated technologies have been enhanced?

Jungheinrich’s global manufacturing footprint has evolved significantly through Industry 4.0 technologies, with a focus on automation, digitalisation, and intelligent networking. Our production facilities, including the Qingpu plant in Shanghai, manufacture trucks for the Asian market by combining globally proven designs with local adaptations. Our digital products, including intelligent warehouse management systems (WMS), fleet management systems (IoT), personal protection systems, AI cameras, and advanced software solutions, help our customers meet their productivity and safety needs. This integration enables real-time data exchange, process optimisation, and higher productivity, supporting smart manufacturing that enhances responsiveness to diverse market demands.

Are you seeing an acceleration in the adoption of automation and AGVs in Indian warehouses, and how is Jungheinrich supporting that shift?

Yes, there is an acceleration in the adoption of automation and AGVs in warehousing across the APAC market. In India, awareness of automation is growing, primarily in the manufacturing sector, and government initiatives such as Make in India, PLI, and government and private capital expenditure are fueling this growth. The primary intent behind implementing AGVs is to relieve human operators of routine, mundane tasks, allowing them to focus on higher-value activities. We support this transition by offering integrated automation solutions, including automated storage and retrieval systems, mobile robots, and AI-powered warehouse management software.

Our fleet management product, ISM Online, enhances operational efficiency and safety by providing detailed analysis and control of forklift fleets. As an expert automation partner, we design and implement customised Automated Guided Vehicle Systems (AGVS) tailored to customer needs, helping warehouses increase cost-effectiveness, streamline processes, and prepare for the future.

How are you managing the balance between manufacturing globally standardised machines and meeting hyper-local customer requirements in diverse regions, such as Thailand, Sri Lanka, and India?We balance global standardisation with the adaptation of local market needs in India and other countries through our local and regional sales and service setup, manufacturing facilities, and deep market insights. With 12 production plants and direct sales companies in 42 countries, supported by partners in over 80 countries, we deliver solutions tailored to operational needs. For example, trucks manufactured at our production facility in Shanghai are adapted to Asian market requirements by combining global quality standards with localised modifications. By working closely with local partners and customers in India, Thailand, Sri Lanka, and other regions, we understand the unique challenges and regulatory environments in these areas. This approach ensures our material handling equipment and systems meet local preferences and industry-specific demands while maintaining global performance and reliability.

How has the India operation contributed to Jungheinrich’s overall growth in the Asia-Pacific region, and what are your expansion priorities here?

India has emerged as a key growth driver for Jungheinrich in the Asia-Pacific region. Supported by various government schemes, India’s rapidly expanding logistics and warehousing sectors—especially in tier II and III cities—offer many opportunities for battery-operated pallet trucks, electric forklifts, reach trucks and our system trucks. Our products and solutions cater to industries of all sizes, enabling us to tap into the vast growth potential of the Indian market.

Our expansion priorities include strengthening the partners and service networks, enhancing the availability of skilled manpower, and introducing advanced sustainable material handling solutions. Our advanced Lithium-Ion Batteries provide sustainable and energy-efficient solutions, remaining central to our product strategy as we support the modernisation of India’s logistics infrastructure and contribute to the overall growth of the Asia-Pacific market.

What challenges do you face in building service infrastructure and skilled manpower in logistics-heavy sectors across South Asia?

We face challenges such as a shortage of trained and skilled operators for material handling equipment, ensuring the timely availability of spare parts, and establishing a widespread service network to support customers across diverse and often remote locations. The rapid growth of the logistics sector in South Asia, coupled with the evolution of technologies such as automation and AGVs, demands continuous workforce upskilling. Supply chain disruptions and rising freight costs further complicate the availability of equipment. Jungheinrich addresses these challenges by investing in comprehensive training programs, expanding its service footprint, and utilising digital tools for proactive maintenance and remote support, thereby enhancing operational reliability and customer satisfaction.

Are Indian users demanding more hybrid automation – a blend of manual and autonomous material handling – and how are you addressing that shift?

Indeed, there is a growing demand in India for hybrid automation solutions that combine manual operations with autonomous technologies, particularly in the manufacturing, warehousing, logistics, distribution, and e-commerce sectors. Hybrid automation enhances efficiency and productivity by automating manual tasks, enabling workers to concentrate on higher-value activities. Consumers now expect quick turnarounds, reshaping traditional workflows. Jungheinrich offers scalable automation options, including semi-automated trucks and mobile robots that operate in conjunction with manual equipment. Our modular automation systems and intelligent warehouse management software enable the seamless integration of hybrid solutions, allowing customers to transition to full automation while gradually optimising their current workflows. We provide end-to-end solutions—hardware, software, and service—from planning through support, ensuring that future-ready warehouses achieve speed, precision, and operational efficiency.

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.

Delta Electronics India has built resilient manufacturing plants in India that support its export market. Niranjan Nayak, MD of Delta Electronics India, shares how localising supply chains and leveraging digital twin platforms support OEMs across the EV, data centre, and automation sectors, positioning India as a global hub for innovation, compliance, and sustainable industrial solutions.

With supply chain volatility becoming the new normal, how has Delta restructured its supply chain to ensure just-in-time delivery and operational continuity across borders?

Delta has responded to global supply chain volatility by adopting a localised procurement strategy, expanding its supplier base in key markets like India, and building a green, low-carbon supply chain.

One major shift has been our move toward a localised procurement and production model. Rather than depending solely on international logistics, we have invested in expanding our regional manufacturing and supplier base, especially in emerging markets like India. This supports just-in-time delivery models, shortens lead times and reduces carbon emissions.

We have also led the development of a “Green Low-carbon Supply Chain” framework, working with more than 250 suppliers to ensure emissions tracking and energy-efficient practices. This includes helping suppliers complete third-party verification for GHG inventories and providing training on international standards like ISO 14064-1. Investments in digital dashboards and predictive tools help monitor disruptions and improve planning, which is especially vital for sectors like data centres and energy infrastructure.

India is emerging as a key global manufacturing hub—what role does Delta’s India operation play in your global roadmap?

India is our critical supply base for local demand and an export hub for international markets. Our manufacturing operations in India—across Krishnagiri, Rudrapur, and Gurgaon—have been designed with flexibility, scale, and sustainability. These facilities serve sectors ranging from electric vehicles and building automation to energy infrastructure and industrial automation.

The Krishnagiri plant has lean production systems and strong quality control processes and is committed to inclusive employment. A large proportion of the workforce here comprises women. In addition to manufacturing, Delta India does regional R&D and product customisation. As India grows as a market for automation, data centres, and EVs, we are developing solutions specifically suited for local operating conditions while aligning with global quality and sustainability benchmarks. Delta India is expected to drive volume and innovation across the company’s key verticals.

Delta serves sectors ranging from EVs to data centres. How do you tailor automation and energy solutions for such diverse OEM needs?

Delta’s strength lies in adapting core technologies into modular, scalable solutions. Delta tailors its product design and delivery through innovation, compliance, and market intelligence, whether it’s high-efficiency power modules for hyperscale data centres, ultra-fast EV chargers, or energy-saving HVAC systems.

In the EV space, our chargers and powertrain solutions are engineered to meet regulatory standards in safety, grid compatibility, energy efficiency, and performance across multiple regions. Delta supports hyperscale clients in data centres with fully integrated systems that include power backup, cooling, and real-time monitoring—all built to meet ISO, IEC, and cybersecurity norms. Our Building Automation solutions further demonstrate this approach. From IAQ monitoring to energy-efficient lighting and water management systems, each component is adaptable to the client’s location, compliance standards, and sustainability targets. These modular systems integrate IoT and AI to manage smart energy while meeting country-specific building codes.

We have embedded ESG and compliance teams into our product development lifecycle to remain ahead of global demands. Products undergo rigorous multi-country testing and certifications such as SEMI E187, ISO 50001, and RE100 alignment. This allows Delta to support clients in achieving their net-zero goals while ensuring fast deployment and reduced regulatory risks. By combining engineering excellence with foresight into global policy trends, Delta remains a trusted partner for OEMs across sectors looking to future-proof their operations and confidently meet regulatory expectations.

What are the biggest friction points international OEMs face when entering new markets, and how is Delta positioned to be more than a vendor but a strategic partner in solving them?

Entering a new market often involves navigating complex regulatory, logistical, and operational challenges. For international OEMs, this can include aligning with local compliance standards, establishing a reliable supply chain, and understanding market-specific needs in product design and delivery.

Delta addresses these friction points by offering more than just off-the-shelf products—we deliver localised, turnkey solutions backed by deep market knowledge and integrated service support. For example, our manufacturing units in India are designed to cater to local and global demands. This allows us to offer scalability and cost-efficiency from a trusted, compliant source. Our engineers and compliance experts work closely with partners to align with global and local standards, including energy efficiency mandates and environmental norms.

What global partnerships or collaborations are you pursuing to drive digital transformation in manufacturing ecosystems?

We are expanding our digital transformation in manufacturing through a mix of strategic partnerships, technology alliances, and sustainability coalitions. We have aligned our digital transformation efforts with our ESG vision by building a robust ecosystem of partners focused on smart manufacturing, energy efficiency, and climate resilience.

One of the flagship initiatives is the rollout of Delta’s DIATwin Digital Twin Platform, which allows clients to simulate, test, and optimise manufacturing setups before they go live. This platform is already used in multiple production environments, reducing commissioning time and enhancing operational efficiency. It enables predictive analytics, remote diagnostics, and lifecycle management, making it an essential tool for modern factories.

Technologically, Delta works with industrial automation players to co-develop open protocols and scalable automation platforms that integrate with legacy systems. This includes energy monitoring software, factory automation components, and advanced robotics designed for Industry 4.0 and AI integration. From a regional perspective, Delta has initiated localised smart factory solutions in key markets like India, aligning with national Industry 4.0 policies. Delta ensures its solutions meet local manufacturing maturity levels while staying globally competitive.

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.

India’s rapidly expanding industrial base, emphasis on “Make in India,” and growing demand in automotive, aerospace, electronics, and defence make it an attractive destination for Italian businesses. India’s demand for advanced technology, reliability, and energy-efficient machinery aligns with Italy’s reputation for innovative solutions. Nilesh Joshi, Business Manager for Italian Machinery at the Italian Machine Tool Association, discusses the current global trade landscape in the machine tool sector, particularly with emerging economies like India.

How does UCIMU view the current landscape of global trade in the machine tool sector, particularly with emerging economies like India?

The current global trade environment presents opportunities and challenges in UCIMU’s focused sectors. We are turning to high-growth economies like India because, despite the solid, mature markets in Europe, development is modest. India’s rapidly expanding industrial base, emphasis on “Make in India”, and growing demand in automotive, aerospace, electronics, and defence make it an attractive destination.

In addition to being an export destination, Italian businesses see India as a possible long-term partner for joint ventures and local manufacturing. India’s demand for advanced technology, reliability, and energy-efficient machinery aligns with Italy’s reputation for innovative solutions.

How does UCIMU facilitate partnerships between Italian machine tool builders and manufacturers in countries like India?

Through our unique initiatives and projects in India, we have established a well-organised ecosystem to promote Italian excellence and industrial collaborations in the machine tool sector. UCIMU plays a key role in supporting the internationalisation of its members. Our Italian Machinery Desk in India with AMAPLAST (Italian Plastic & Rubber Machinery Association) based at the Indo-Italian Chamber of Commerce (IICCI) and the Italian Technology Centre – a dedicated market development platform for associations’ member companies with a presence in Pune & Delhi – serves as a concrete platform allowing Indian manufacturers to directly engage with Italian machine tool builders for technology requirements, information about the Italian machine tool sector, technical support, and customised solutions.

Our collaboration with Italian Trade Agency (ITA) offices in India and our long association with the Indo-Italian Chamber of Commerce for promotional initiatives actively facilitate B2B matchmaking, industrial delegations, and participation in trade fairs like IMTEX. We also have to stress the importance of our partnership agreement with IMTMA (Indian Machine Tool Manufacturers’ Association), with collaborations in different fields on behalf of members of both associations: technical standards, joint promotion, participation in sectoral exhibitions, etc.

How has globalisation influenced the operations of Italian OEMs, and what challenges do they face in borderless trade?

Globalisation has allowed Italian OEMs to reach customers in different parts of the world. Companies have set up technology centres, demos, services, warehouses, and manufacturing units in other countries to provide faster support and proximity to clients.

This global presence brings many benefits and some challenges. For example, companies must manage different time zones, offer round-the-clock support, and compete with local manufacturers from a commercial perspective. Sometimes, even though we talk about a ‘borderless’ trade environment, differences in regulations, import duties, or local manufacturing rules can make international business more complex. These aren’t necessarily barriers but require careful planning and understanding of each market.

How are ongoing geopolitical tensions (such as the US-China trade disputes and Brexit, etc.) affecting global trade and the resilience of supply chains for Italian machine tool manufacturers?

In today’s interconnected world, shifts in geopolitical dynamics naturally influence global trade flows and supply chain strategies. Like many of their international counterparts, Italian machine tool manufacturers closely monitor these developments and adapt with a greater focus on resilience and flexibility. This includes reassessing sourcing strategies, exploring regional diversification, and strengthening partnerships in markets with stable long-term growth prospects, such as India. The goal is to ensure continuity of service, maintain high delivery standards, and remain responsive to customer needs in the developing global environment. Rather than viewing these changes as disruptions, many Italian companies see them as opportunities to innovate and build more active supply chains.

How do you see the role of global standards and certifications in enabling seamless trade and interoperability in the machine tools industry?

Global standards and certifications are fundamental in today’s machine tool industry. They ensure quality, safety, and compatibility across borders, essential for operating in multiple markets. Italian manufacturers are known for engineering excellence and comply with major international standards such as ISO, CE, and Industry 4.0 readiness norms.

Our UCIMU mark certification demonstrates the commitment of Italian machine tool manufacturers to quality, efficiency and environmental sustainability, which can enhance market differentiation and consumer confidence. For emerging markets like India, adherence to global standards helps local users integrate seamlessly into global supply chains. As digitalisation and smart manufacturing grow, it will become increasingly important for machines, software, and systems to work together seamlessly. This will require following common standards, making certifications even more important for future trade.

What support does UCIMU offer to help Italian SMEs integrate into the supply chains of large global OEMs and establish a foothold in growing markets like India?

We, with Italian institutions, provide comprehensive support to SMEs, which form the backbone of the Italian industrial system. These include export promotion programs, internationalisation initiatives, credit finance facilities, collaboration with Italian financial institutions, customised market intelligence, business matchmaking events, and training. Specific to India, we are organising collaborative programs such as technical webinars, seminars, and Italy country pavilions organisations in key Indian international exhibitions, providing a platform to Italian SMEs for establishing a foothold in the growing Indian market.

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.

As global supply chains evolve and manufacturing becomes smarter, OEMs need agile automation partners to deliver local adaptability and international quality. Inovance Technology provides OEMs with intelligent, industry-specific solutions that drive resilience, innovation, and scalable growth in India and worldwide.

What role does Inovance play in helping global OEMs diversify and de-risk their supply chains while maintaining production quality and agility across borders?

OEMs today are looking to rebalance production footprints, focusing on diversifying supplier bases, establishing regional manufacturing hubs, and leveraging local talent to mitigate global uncertainties. Inovance is key to this transformation, offering vertically integrated R&D and manufacturing capabilities. Our ability to deliver consistent quality, standardised protocols, and rapid local service support positions us as a dependable global partner.

For instance, our advanced motion control systems and servo solutions are deployed across diverse markets with region-specific customisations, enabling OEMs to scale efficiently without compromising performance.

From your experience, what are the most important traits global OEMs now look for in their automation partners, and how is Inovance evolving to meet those expectations?

From my engagement with leading OEMs, I’ve observed three traits that are now non-negotiable in automation partnerships: Responsiveness and local support, integration readiness (with Industry 4.0 compatibility), and engineering depth with cost efficiency.

Inovance is constantly evolving to meet these expectations. Our automation solutions are designed with modular, open interfaces that integrate seamlessly with third-party systems and IIoT platforms. Additionally, our operations include a growing application engineering and product development team working closely with OEMs to co-engineer solutions tailored to local and global markets.

What partnerships or collaborations is Inovance pursuing globally to fast-track innovation and respond to the rising demand for smart, flexible manufacturing solutions?

Innovation cannot be siloed. At Inovance, we are actively forging global collaborations with technology partners and OEMs to fast-track advancements in AI-driven predictive maintenance, vision-based quality control, and autonomous robotic systems.

Our participation in expos reflects our commitment to the global innovation dialogue. We showcase our offerings through these platforms and engage with OEMs to co-create future-ready automation blueprints.

With India becoming a key market for manufacturing, what role does Inovance’s India strategy play in your global growth vision?

India’s emergence as a global manufacturing hub is a major pillar in Inovance’s international growth strategy. With its large pool of skilled engineers, favourable policy environment, and increasing demand for intelligent automation, India offers the ideal ground for development and scale.

We have significantly expanded our India operations—with a new office, robust distributor networks across key industrial zones, and tailored training programs for OEMs and system integrators. Additionally, we are localising our product lineup to meet regional technical standards, price sensitivities, and infrastructural nuances without compromising global benchmarks.

Inovance offers various industry-specific automation solutions, from textiles to packaging. How are you adapting these for highly localised yet globally integrated manufacturing environments?

Whether our Ethercat-based motion controllers for packaging OEMs, SCARA and 6-axis robots for assembly lines, or our textile automation drives, Inovance’s solutions are designed with vertical expertise and global scalability.

The real challenge lies in adapting these technologies to manufacturing environments that are simultaneously highly localised and globally integrated. Our strategy involves a hybrid approach: developing core technologies at global R&D hubs while enabling region-specific application customisation through local engineering support.

Inovance Technology is a long-term innovation partner. As OEMs reimagine manufacturing for a smarter, more resilient future, we stand ready to deliver intelligent automation that bridges continents, scales with agility, and adapts to the industry’s future.

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.

Cummins India is decarbonising with the ‘Destination Zero’ strategy, which is helping them with product innovation and operational excellence. Ashish Aggarwal from Cummins India shares how they empower and improve their portfolio in line with this strategy.

Cummins has been a global name in power solutions. How do you align your India operations with your global roadmap while catering to local market needs?

With a strong legacy of powering India’s growth for over six decades, Cummins’ India operations are deeply integrated with our global vision. This vision is built on the foundations of local integration, continuous innovation, and an unwavering commitment to sustainability.

India presents unique requirements, from diverse customer preferences to market dynamics and evolving regulatory requirements. Our decarbonization strategy, Destination Zero, acknowledges these realities. It reflects our commitment to reducing emissions, driving product innovation, and achieving operational excellence. In line with this strategy, we offer customers the ‘power of choice’ by providing a comprehensive portfolio of technologies to choose the best-suited solutions for their operational needs. This approach directly supports national priorities, such as the “Make in India” initiative, skill development, and our country’s long-term sustainability goals.

Additionally, Cummins Technical Center India (CTCI), with over 3,000 engineers, plays a critical role as an innovation hub for India and global markets. The technical center enables us to adapt global technologies and develop India-specific solutions, further strengthening our ability to deliver relevant, reliable, and future-ready solutions.

How is Cummins prepared for future disruptions (climate change, trade wars, cybersecurity threats)?

As the creator of products that power some of the world’s most demanding and economically vital industries, resilience and adaptability are core to operating, continuously innovating, and serving our customers.

We understand that future disruptions, driven by climate change, evolving trade dynamics, or cybersecurity threats, require proactive and strategic responses.

Through our Destination Zero decarbonisation strategy, we are investing in next-generation technologies while creating a diverse portfolio of future technologies that empower customers with the right solutions at the right time, no matter where they are in their decarbonization journeys. This diversification ensures that we are well-positioned to meet the evolving regulatory and market expectations across different geographies.

We have built a globally connected and digitally enabled supply chain that leverages a diversified network of local suppliers. This enhances our ability to manage risks and maintain business continuity even in volatile environments. Cybersecurity is another critical focus area for us. We have established robust protocols, and our teams conduct regular threat assessment audits and maintain strong incident response protocols to safeguard our operations, customers, and partners from evolving cyber threats.

Organizationally, we promote a culture of agility and continuous learning, enabling us to respond rapidly to unforeseen challenges and opportunities.

Is Cummins adopting any localisation–globalisation balance strategy (“glocalisation”) for key components or technologies? How do you source the products for manufacturing in India and for India?

Our products are designed, engineered, and manufactured in India, serving local customers and global export markets. Our glocalization strategy leverages India’s strong supplier base to source critical components and parts with limited global availability or where dual sourcing is essential for supply chain resilience.

This has enabled us to maintain a resilient and agile supply chain amidst global volatility. Beyond our manufacturing footprint in India, our international operations also benefit from sourcing components from several independent vendors across India. By cultivating these strong local partnerships, we enhance our cost competitiveness and supply chain resilience and contribute meaningfully to the growth of India’s manufacturing ecosystem, aligning with the national vision of “Atmanirbhar Bharat.”

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.