WELDING INDIA

By admin July 21, 2011 7:08 am IST

Welding industry in India is heading towards tremendous growth with the increased government’s spending in infrastructure building such as construction and energy. Welding is also an essential element in the field of steel, shipbuilding, oil & gas, automotive manufacturing and many more. This time, OEM Update reaches out to the industry players and brings you the in-depth analysis of welding equipment industry.

Can you tell us about the latest technology development in the field of welding? Manu Gulati, Migatronic India: The field of welding in India has for far too long been dominated by low end and low price products. However, the effects of globalisation started taking shape in India in the late 90’s with the Indian customer desiring better quality and technology products than what was in use. This boosted the sale of digital inverter based machines and exposed the Indian welding industry to the ‘best in class’ products. Nimesh S Chinoy, Electronics Devices: Globally, the welding Technology has migrated from welding transformers to rectifiers and thyresters to welding inverters. Power saving, ease of operation and the light weight of equipment are major benefits. However, in India migration to welding inverter is happening at a very slow pace. This is primarily due to lower price and welders’ convenience with traditional range of welding equipment. The Government and welding industry majors need to take initiative and positive steps to convince and encourage consumers about the real benefits of using welding inverters. We see very good growth opportunities for welding inverters market in the coming years. Milan Supanekar, WTI: Currently, robotic welding, orbital TIG welding, stud welding, and laser welding are some of the few new latest technologies.

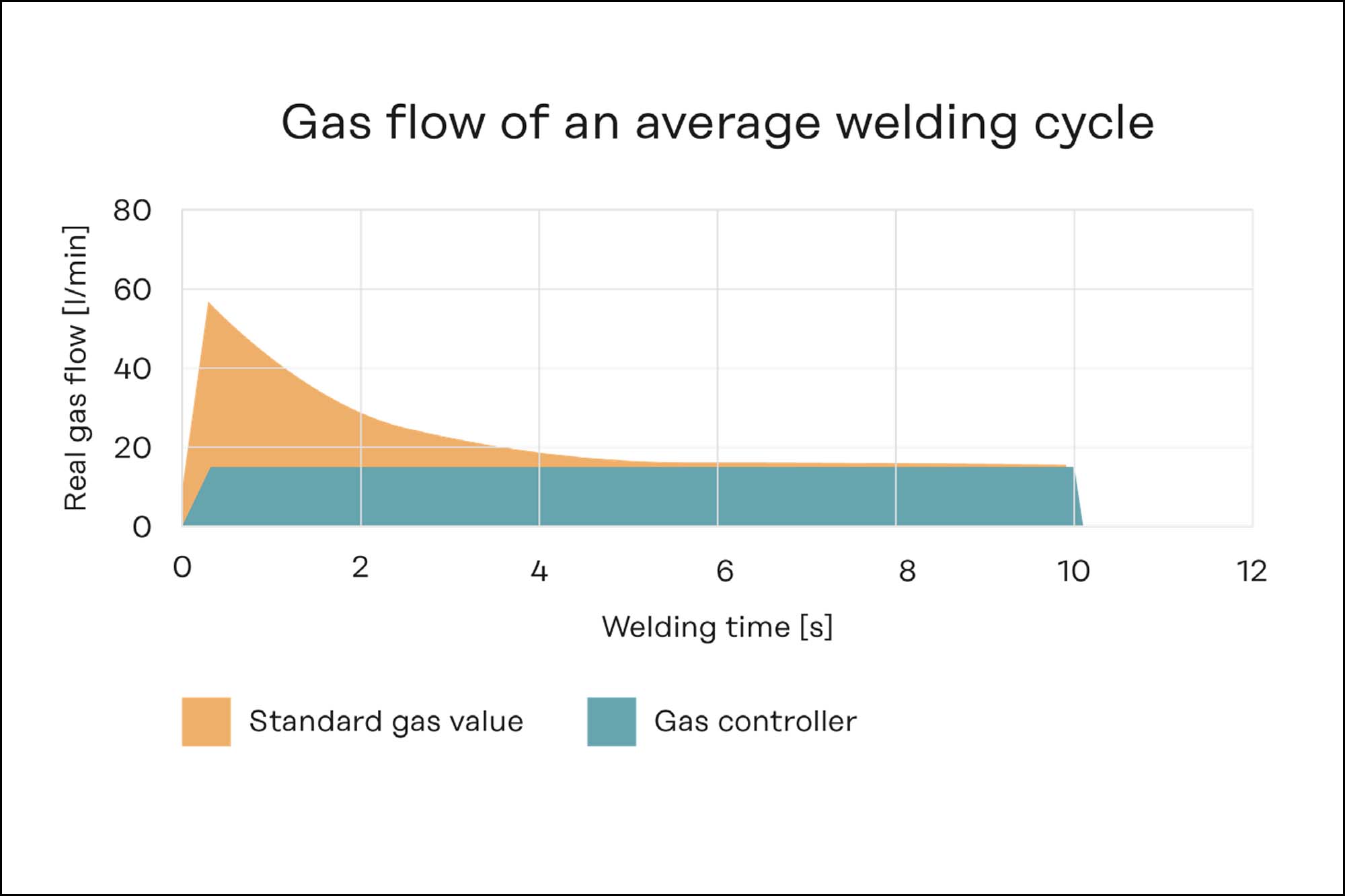

Gulati: Over the time, the R&D department at Migatronic has developed some new products as well as added new features in the existing models to enable the company to move up the value chain. Some of the latest technological developments at Migatronic have been the DOC (dynamic oxide control) system for welding of aluminium, IGC (intelligent gas control) for large scale savings in gas consumption, IAC (intelligent arc control) for automatic arc adjustment.

What are the prime growth drivers for welding equipment market in India? Gulati: India has emerged as the second fastest growing economy in the world after China and is expected to register a GDP of 8 per cent. Surging exports, huge FDI in the manufacturing sector, government emphasis on infrastructure projects are fuelling the growth of the welding equipment market in India. The country is turning out to be an attractive investment destination and the future holds good for the capital equipment industry in India.

Chinoy: The GDP growth at around 9 per cent primarily due to growth in infrastructure. The development of major rail corridors, shipping industry, power sector, engineering industry and auto industry are major growth drivers. The replacement of existing welding transformers and rectifiers offers a huge opportunity welding inverter market. Supanekar: The demand for new equipment is directly linked to growth of construction equipment, shipbuilding, automobiles, structural fabrication for new projects, material handling equipment such as cranes, conveyors etc. What are the major roadblocks for the industry today? Gulati: Infrastructure bottlenecks especially in energy, roads and ports are the major roadblocks for the Indian industry. The lack of enough skilled manpower is also turning out to be a big headache for the industry.

Chinoy: The welding equipment industry is very fragmented. There are many small scale welding manufacturers. Research & Development efforts by these small scale industries are very minimal that the quality of welding machines manufactured by them is not comparable with international machines. Low priced conventional machines like transformers, thyresters and rectifiers by small scale industry and low priced Chinese machines are hurting growth of welding industry. Organised welding equipment manufacturers need to take initiative in R & D and make world class products available at affordable prices in market. Government should also take steps to encourage industry to invest heavily in research & development and products innovation.

Supanekar: Availability of skilled manpower, awareness of the products, and availability of funds especially in the small scale industries are the major roadblocks. Globally, the gradual move from manual to automatic and semi-automatic welding equipment is driving the growth for welding market. But the Indian market is still dominated by the use of manual welding equipment. What is your opinion in this regard? Gulati: Traditionally, the Indian welding industry has been dominated by manual processes and the switch to automatic and semi-automatic processes was slow. In recent times, though, the situation has been changing and the move from manual to automatic process has seen an acceleration which is evident from a large number of robotic installations especially in the auto sector. The lack of enough skilled welders is also forcing the Indian industry to move over to more productive processes.

Chinoy: Historically, due to low labour cost, it is an established industry practice to have manual welding production processes. However with globalisation and economic reforms by the Government of India, the Indian industry also have started exploring welding automation, semi-automated welding processes with a view to improve productivity and reduce production cost. In the years to come, we feel more and more industry players will migrate to welding automation.

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.