Our equipment has long life – it lasts for 10 years

By admin October 21, 2009 5:29 am IST

“Our equipment has long life – it lasts for 10 years”

Milind M. Shahane, Deputy Chief Operating Officer, Voltas Ltd, shares the triumphs and traumas the company has experienced with Dilip S. Phansalkar

How has the MHE industry evolved over the years to keep pace with growing construction activity?

With regards to material handling, we call it ‘discreet material handling. There are two parts to material handling – one is bulk commodity such as cement, ore, fertilizers, etc. But we’re not into that. We’re into equipment which handles loads – things that can be put on pallets or in containers. So that’s our area of activity we’re involved in.

When you look at material handling, generally it can be in both parts. Discrete material handling is known as unit material handling. This consists of forklifts, cranes and other warehousing equipment, and handles packages and pallets, etc. This industry has really evolved over the past 10-15 years or even over a longer period than that. It has kept pace with changing trends of the Indian market.

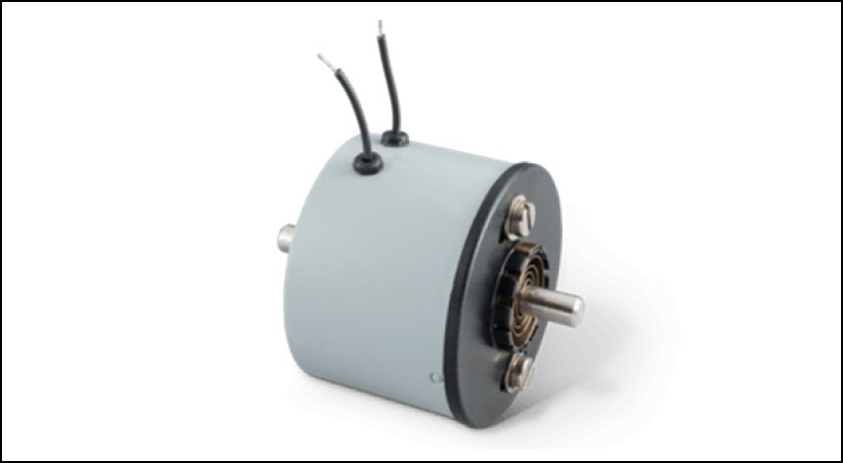

More and more types of equipment are coming in. Ten years ago warehousing equipment didn’t even exist. The difference between warehousing equipment and forklifts is that these are more electric-driven and used inside warehouses for stacking on racks. Also, more automation handling is being put into practice nowadays. So it has kept pace with the needs of modern times and the industry is still being evolved. However, significant growth has taken place only in the past 4 to 5 years when the Indian industry started making rapid strides.

What have been a few landmark achievements by Voltas in the industry?

We have had a long string of achievements. Voltas has been one of the pioneers in the material handling equipment industry in India. We began manufacturing in 1967, and were the first to enter the forklift business in the 1960s. We’ve been inthe business for nearly 50 years. We’re the first to get certification for ISO; the first manufacturer to obtain ARAI certification for road worthiness of the equipment; we’re the first to launch warehousing products 10 years ago. We also have the highest number of machines (between 9,000 and 10,000) active in the field. So these are some of our significant landmark achievements.

What are some of the bottlenecks the company comes across when undertaking projects in India and abroad?

The main bottlenecks are in executing projects and supplying machines. Also, there are a lot of administrative hurdles in terms of transportation, clearance permits, octroi, local taxes – these are some of the issues we face. Similarly, when we import items for making equipment, we sometimes obtain material from our partners. Then there are delays at ports and customs. For export projects, we send MHE to Africa, South East Asia – there again we’ve problems in export documentations. If only the government simplify these procedures, we’d be more competitive than other countries like China.

What changes has conventional material handling undergone in recent years?

Over the years material handling has become more automated. Secondly, more and more electronic-controlled systems have been introduced – such as in terms of cranes. These systems have added to the safety of equipment and the operator. The third area is the design – making MHE more ergonomic, in terms of improving efficiency. The emission and fuel consumption area has also improved – from diesel-driven to electric-driven equipment. Our equipment now comes under Euro norm.

What impact does competition have on the business?

One cannot deny that competition is very high. There are different competitors for different product segments. In India, for instance, there is Godrej; then there are European, Japanese and Chinese companies coming to India to supply the equipment. In areas like cranes, we’ve competitors like TIL. Besides, we’ve international competitors, too. As a result, we compete on prices which affect our profit margins.

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.