3 trends impacting Indian machine tool market

By OEM Update Editorial April 12, 2017 10:28 am IST

A look at the current market trends that are impacting the machine tool market in India.

The machine tool market in India is increasing exponentially day by day. As a result of the growing demand, the country is set to become a key player in terms of global machine tools industry and is likely to see substantial high-end machine tool manufacturing. It is largely expected that the platforms like ‘Make in India’ coupled with the growth in manufacturing are said to be the results of the growing demand in the machine tools sector. Here are a few trends that are impacting the machine tool market in India.

Industry 4.0: the smart factory

“The machine tools industry has evolved with the development of both hardware technology and software applications. This has resulted in machines becoming faster, intelligent, and versatile,” says Keshav Khurana, Executive Director, Wohlhaupter India Pvt Ltd. He believes that machines have now become multifunctional and are capable of performing a broad range of tasks inside a single set up.

The standardisation of multiple products on a single platform is possible. The advanced CAM technology is being used for multi-axis, multi-spindle, and multi-turret machines. In addition to this, the software are increasing being used for automation of manufacturing and engineering processes. Speaking more about the software applications, Khurana says, “Software applications provide an integrated view of operation through direct integration with product lifecycle management, manufacturing execution services, process planning, and enterprise resource planning systems.”

Industry 4.0 creates what has been called a ‘smart factory’. Explaining about the term smart factory, Khurana says, “Within the modular structured smart factories, cyber-physical systems monitor physical processes, create a virtual copy of the physical world and make decentralised decisions.”

Over the Internet of Things (IoT), cyber-physical systems communicate and cooperate with each other and with humans in real time, and via the Internet of Services (IoS), both internal and cross-organisational services are offered and used by participants of the value chain. Khurana also belives that the supply chains could be more readily controlled when there is data at every level of the manufacturing and delivery process. It is believed that computer control could produce much more reliable and consistent productivity and output. This can cause an increased revenue, market share and also growth in profits.

While speaking about the market size in India with respect to the machine tool industry in 2020, Khurana says, “The machine tool market in India is growing every year. We can easily reach $2.5-3 billion by 2020.” Khurana observes that the rise in exports by the Indian manufacturers, be it OEMs or tier-1 and 2 companies is a factor due to the lower costs here.

He further adds, “Increasing quality standards, lower wages and associated manufacturing costs as compared to the foreign market are advantages which India has. Even a lot of automobile manufacturers which for years stayed away from India even for selling as imports are now setting up their manufacturing bases here.”

As per Khurana, India is seen as an export facility by many manufacturers. The ‘Make in India’ campaign launched by the Indian government is considered to be a hot attractive point for investors too. Make in India has in all means become a keyword for attracting local production. “We have all sorts of research and development facilities to work upon newer trends. Domestic machine tools manufacturers have advantages in terms of cost and after-sales, but technology development will be critical to meet customer requirements,” says Khurana. Apart from this, there are some areas that need improvement. They include performance, access, ergonomics and aesthetics. An increase in defence and aerospace manufacturing in India will also help.

Additive and subtractive manufacturing

Automation and smart are the buzzwordsSpeaking about the trends that are impacting the machine tool market in India, Lalit Sharma, Director, Rigibore India Pvt Ltd says, “ The sentiment has been positive in most of the manufacturing sectors with the recent impetus given to make India a manufacturing hub.” He also adds that the FDI attraction into various manufacturing sectors following the ‘Make in India’ policy initiative gives a fairly clear indication of an uptick in manufacturing going forward.

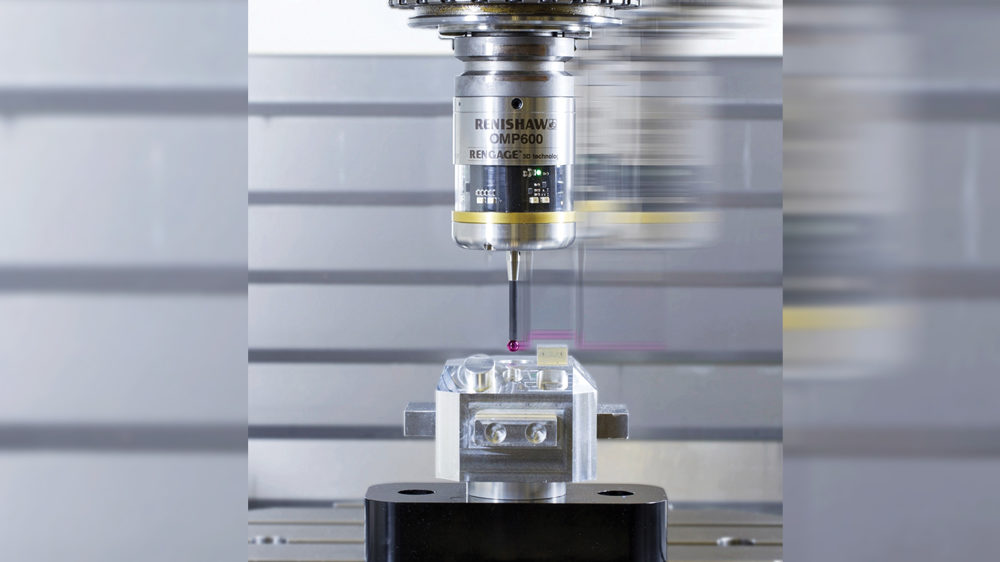

Sharma further adds that automation and smart will be the buzzwords going forward and the trend will move towards machines being interfaced with automation systems and smart controls. Adding more on this, he says, “Reduced manual intervention in process control using the machine tool control system and smart tooling will be the key to optimising costs, scrap reduction and improved machine utilisation.” Globally, many advanced manufacturing markets have adopted these technologies and the trend is set for the Indian machine tool industry to address the technology-gap and drive innovation in this direction. In addition to this, the improved quality, capabilities for machining high precision components, and improved productivity will be the key factors to stay ahead of competing markets like China.

Even if there are many positives, Sharma believes that the machine tools industry must continually innovate to improve quality, enhance productivity by maximum machine utilisation and improved costs savings by better part control utilizing automation and other smart techniques.

Commenting about the market size for machine tools in India, Sharma says, “At present, the market size is about $16 billion. Explaining further, he says, “This includes both domestic machines and imports with the domestic manufacturing share being around 45 per cent presently. With a stable government factored in, reforms are likely to be pushed through more easily going forward.”

Sharma observes that with the interest rates forecasted to be tending lower in the medium term, increasing domestic consumption, and the government capital spending expected to increase, the machine tool market should grow at about 13 to 15 per cent CAGR going forward for the next few years. “We should be looking at a total machine tool market size of about $3 billion by the year 2020,” concludes Sharma.

Conclusion

Thus, with the growing influence of upcoming software like Internet of Things (IoT) and Internet of Services (IoS), coupled with the revolutions like Industry 4.0, it is very much certain that the Indian machine tool market is set to create new records, both in terms of quantity and quality. The reduced manual intervention will help in getting the best out of the machines.

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.